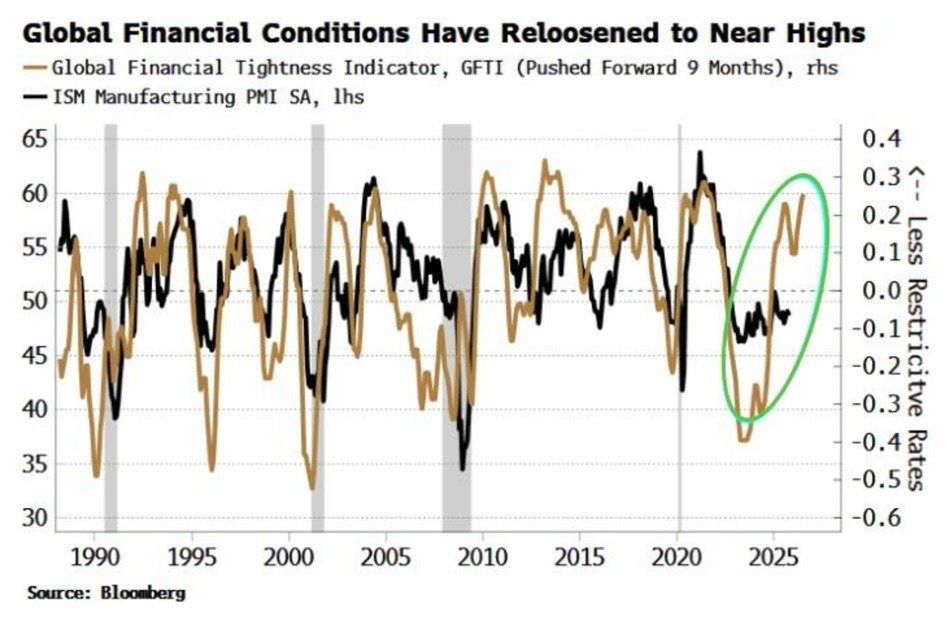

90% of Global Central Banks Ease Policy as Financial Conditions Return to 2021 Levels

- Global financial conditions have eased substantially in recent months, returning to levels last seen in 2021. The latest data shows the Global Financial Tightness Indicator pushing sharply higher, signaling one of the most accommodative environments in years. The indicator has climbed from one of its most restrictive points since 2001 to near the upper range associated with easier financial conditions. Meanwhile, the ISM Manufacturing PMI has begun to stabilize after a prolonged decline, suggesting early signs of improving activity.

- This easing follows two years of tightening that sent global financial conditions to their harshest levels in more than two decades. The recent move resembles the post-2008 pattern, when worldwide policy support helped reverse recession-induced stress. The visual trend confirms a similar steep improvement today, driven by slowing inflation pressures, reduced expectations of further rate hikes, and monetary policy recalibration across major economies.

More than 90 percent of global central banks have either held rates steady or cut them over the past 12 months, the highest share since the stimulus-heavy period of 2020–2021.

- A major factor behind this shift is the synchronized stance of central banks worldwide. This coordinated move has helped push the financial tightness indicator firmly higher, even as the ISM PMI remains below long-term averages and continues to reflect a cautious manufacturing outlook.

- The easing of global financial conditions plays a meaningful role in shaping risk appetite, liquidity flows, and macroeconomic stability. Softer conditions can support equity valuations, lower refinancing burdens, and improve capital availability across developed and emerging markets. With monetary policy now among the loosest seen since the pandemic, markets will be watching whether this shift translates into a durable economic rebound or if growth remains constrained by lingering structural pressures.

My Take: This coordinated pivot by central banks could mark a turning point for risk assets, but the real test lies ahead. Manufacturing data remains weak, and the question is whether easier money alone can overcome structural headwinds or simply inflate asset prices without genuine growth.

Source: The Kobeissi Letter