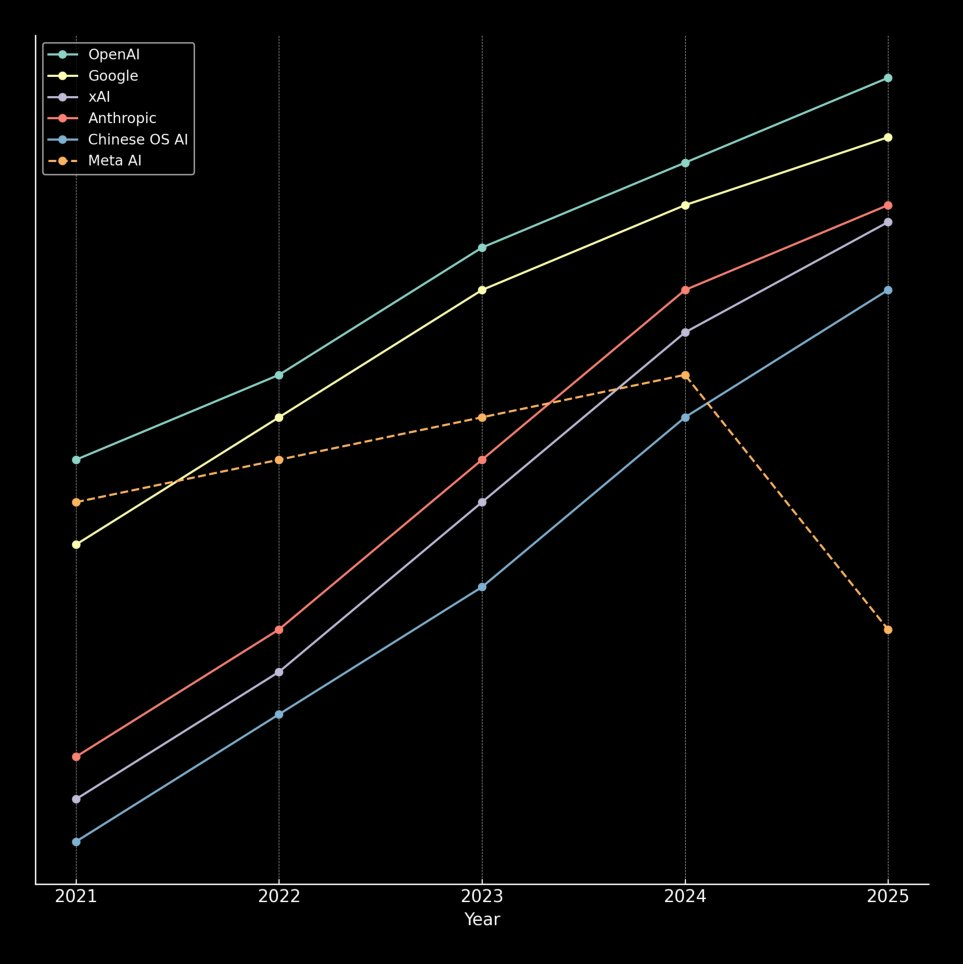

Meta AI Falls Behind Rivals as 2025 Data Shows Sharp Slowdown

- Fresh performance data reveals Meta AI losing ground to major competitors, with 2025 showing a sharp reversal while rivals continue their upward climb. The comparison tracks model improvements across OpenAI, Google, xAI, Anthropic, and leading Chinese AI systems, painting a concerning picture for Meta’s competitive position.

- OpenAI holds the top spot in the latest measurements, with Google trailing closely. Both companies show consistent capability gains from 2021 through 2025. xAI and Anthropic demonstrate particularly strong acceleration, climbing from lower positions to challenge the frontrunners by year’s end. Chinese AI systems also push forward meaningfully, now outpacing Meta’s current results. The contrast is striking: every major player trends upward except Meta, whose line drops sharply after reaching its 2024 peak.

The shift matters because competitive velocity in frontier AI increasingly drives market expectations, research partnerships, and ecosystem alignment.

- Meta’s trajectory tracked reasonably with the industry through 2024, making the 2025 downturn all the more surprising. While Mistral’s modest retreat makes sense given its small-startup status, Meta’s decline raises real questions about strategic direction. The company now trails not just American competitors but several Chinese research groups, marking the only major developer showing negative momentum in the current cycle.

- This performance gap carries weight beyond benchmarks. As OpenAI and Google extend their lead and newer players accelerate, Meta faces mounting pressure to regain competitive velocity. The frontier AI landscape moves fast, and perceived slowdowns can quickly reshape partnerships, talent flow, and market positioning. With rivals strengthening across the board, Meta’s challenge is clear: reverse the trend or risk falling further behind in the next generation of AI development.

My Take: Meta’s 2025 slide is genuinely surprising given their resources and talent depth. The gap widening against both US giants and Chinese labs suggests deeper strategic or execution issues rather than just one bad quarter.

Source: Haider