NVDA News: China Chip Shift Signals Major Market Turn from 40% to 8%

- U.S. export bans on advanced AI chips have triggered a dramatic restructuring of China’s semiconductor landscape. What was intended to slow China’s access to high-performance processors has instead accelerated the country’s push for technological independence, reshaping demand patterns and defining a new chapter in NVDA news.

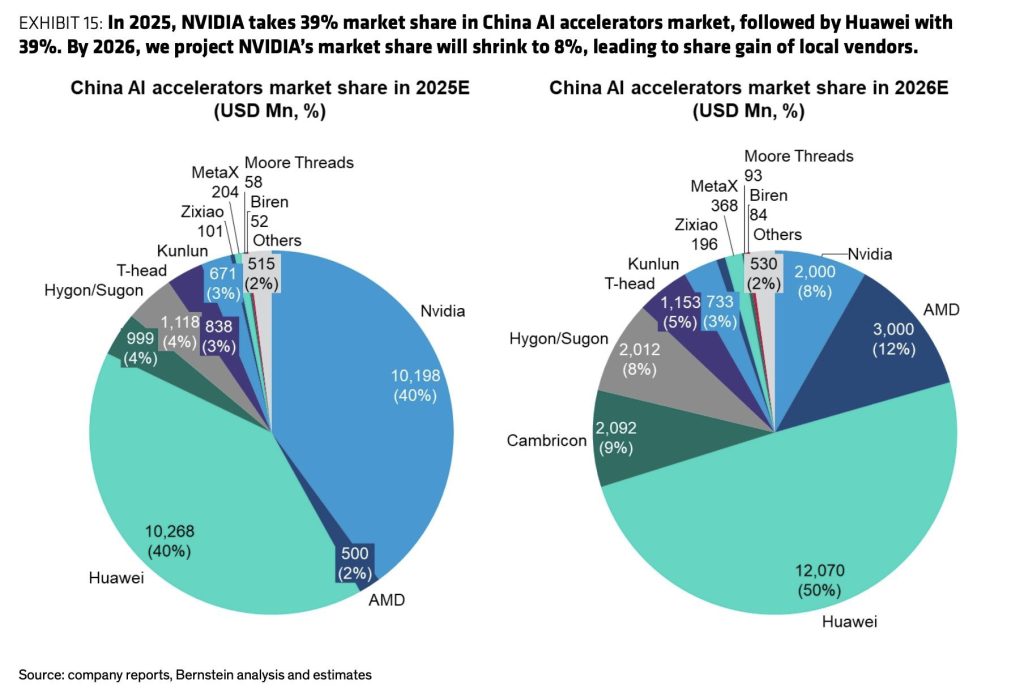

- The restrictions have created immediate challenges for global chip suppliers. Nvidia, which currently holds about 40 percent of China’s AI accelerator market, is projected to see its share collapse to just 8 percent next year. This shift poses meaningful risks to revenue, competitive positioning, and long-term market access as China redirects spending toward local manufacturers. It also raises concerns about talent migration, fragmentation of supply chains, and the possibility of structurally reduced demand for foreign chips in the world’s largest AI market.

“Export bans on AI chips to China have done more harm than good,” as restrictions forced Chinese companies to scale their domestic chip development at unprecedented speed.

- Financial projections indicate that nearly the entire gap left by Nvidia will be filled by domestic alternatives. Chinese vendors are expected to capture roughly 70 percent of the market in 2026, with Huawei alone projected to exceed 50 percent market share. This reallocation reflects not only the financial impact of the export ban but also China’s counter-strategy: replace restricted U.S. components with homegrown designs. The shift reshapes capital flows, affects tax contributions tied to semiconductor imports, and signals a long-term redirection of R&D funding and industrial policy.

- The broader context involves more than Nvidia’s decline. Companies such as Huawei, Hygon, Cambricon, and Kunlun are gaining momentum, accelerating China’s independence in critical AI hardware. Such structural changes carry far-reaching consequences for global market competition, employment distribution, and future technology leadership. The export restrictions ultimately urged China to push harder for self-sufficiency, and the rapid expansion of domestic AI chip capability now demonstrates how decisively that shift has taken hold.

My Take: This represents a textbook case of unintended consequences in trade policy. While the export restrictions aimed to maintain technological advantage, they’ve essentially handed China a compelling reason to build what may become a parallel chip ecosystem—potentially more competitive and cost-effective than anticipated.

Source: Oguz O. | 𝕏 Capitalist