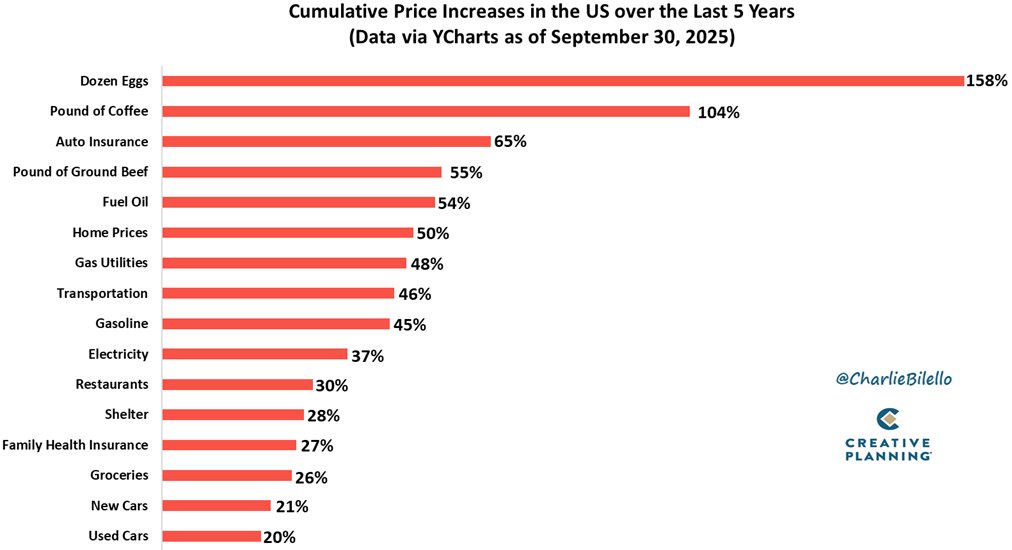

US Inflation Surge Exposes the Myth of 2% Price Growth

- The popular notion of “2% inflation” doesn’t match what American households actually face at checkout. A recent chart based on YCharts data through September 2025 shows essential goods prices have surged dramatically over five years—far beyond what officials call a stable inflation environment.

- The numbers tell the story: eggs up 158%, coffee up 104%, and auto insurance up 65%. Meanwhile, electricity rose 37%, groceries 26%, shelter 28%, and family health insurance 27%. These aren’t small fluctuations—they’re fundamental shifts in household budgets.

- This reality comes as new tax reform proposals introduce higher burdens across industries. Experts worry these changes could trigger more bankruptcies and push companies to relocate. Many businesses argue they simply can’t absorb additional taxation while already struggling with elevated costs.

- Economists warn the reforms could backfire. Instead of boosting revenues, they might shrink the tax base as profitability drops. Some industry voices suggest adjusting profit taxes rather than broad operational levies—a move they say would avoid worsening the inflationary squeeze on both companies and consumers.

- The broader amendments could reshape employment and regional tax contributions. With prices climbing across nearly all essential categories, additional financial pressure might reduce hiring and lower overall tax revenues—the opposite of what policymakers want.

- The gap between official inflation targets and everyday economic reality keeps widening. The data backs up what most people already know: inflation remains stubbornly high, and upcoming tax decisions could either ease the burden or make things worse for businesses and households alike.

Source: Charlie Bilello