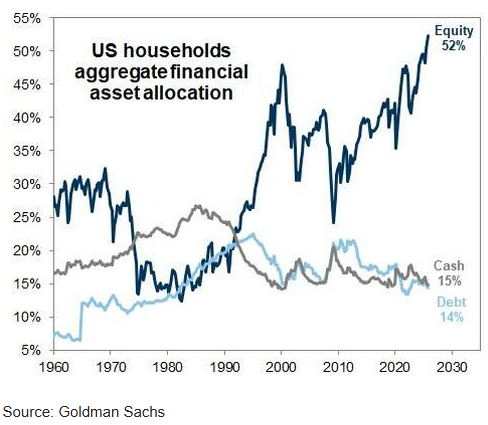

US Equity Allocation Reaches Historic Peak

- Here’s something wild: U.S. households are now putting 52% of their total financial assets into equities. That’s higher than the Dot-Com peak, which is saying something. The data shows stocks at all-time highs while cash and debt sit around 15% and 14%. What this really means is that Americans are more exposed to the stock market than ever before—and that makes them incredibly sensitive to any policy shake-ups.

- Washington’s already paying attention. There’s talk about hiking taxes on investment income—capital gains, dividends, the usual suspects. The argument goes that with households so deep in equities, now might be the time to tap that wealth for budget relief. But there’s a flip side: critics worry these tax hikes could backfire badly. Think less liquidity, fewer retail investors jumping in, and pressure on smaller trading platforms. Worst case? Money flows overseas, financial talent leaves major hubs, and businesses that depend on healthy markets take a hit.

- The financial fallout could be real. One industry letter warns that higher investment taxes might actually create budget shortfalls if investors simply pull back and trade less. The counter-proposal? Raise corporate profit taxes instead. The logic is simple: you’d still get the revenue without spooking the millions of households who’ve bet big on stocks.

- This isn’t happening in a vacuum. Regulators are reviewing everything from capital-gains reporting to how long-term holdings get taxed. If major changes go through, we’re talking potential job losses across financial services, lower income tax collections from those layoffs, and weaker corporate tax revenue if companies scale back investment. With equity exposure at a historic peak, even small regulatory tweaks could have outsized consequences for both household wealth and government coffers.

Source: Barchart