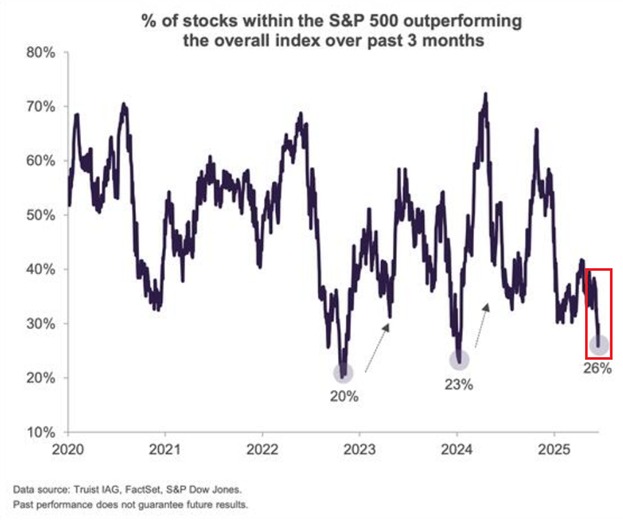

Stock Market Breadth Weakens as Tech Dominance Intensifies

- U.S. stock market breadth is showing serious cracks. Just 26% of S&P 500 companies have beaten the index over the past three months—one of the weakest readings in years. That’s a sharp 40-point drop since November 2024, putting current levels near historic lows like the 20% seen during the 2022 bear market and the 23% in early 2024.

- What’s driving the S&P higher? A handful of mega-cap tech stocks. The rest of the market is struggling. Only 55% of S&P 500 stocks are trading above their 200-day moving average—the weakest since June. While the index looks strong on the surface, participation underneath is crumbling.

- This narrow leadership is a red flag. When fewer than one-third of stocks outperform the benchmark, volatility usually picks up and the market becomes fragile—vulnerable to earnings misses or shifts in sentiment. History shows this kind of breadth weakness often precedes pullbacks.

- The takeaway? Big tech is carrying the market right now. Whether this concentration is temporary or signals deeper trouble remains unclear, but healthy markets typically need broader participation to sustain rallies. For now, tech stocks are calling the shots for the entire S&P 500.

Source: The Kobeissi Letter