Intel Stock Rockets 50% – Traders Cash In While Investors Stay Skeptical

Here’s a perfect example of why perspective matters in markets. While long-term investors had basically given up on Intel after years of watching it fall behind Nvidia and AMD, traders saw something different entirely.

The Numbers Don’t Lie

Market commentator InvestiBrew nailed it in a recent tweet, highlighting how the same stock can look like trash to an investor but gold to a trader. That trader’s perspective just paid off big time.

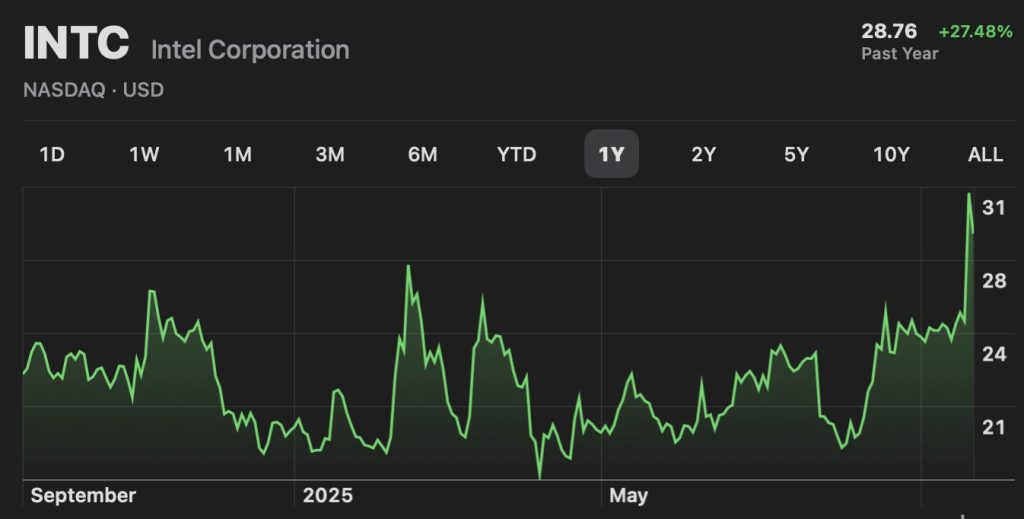

Intel’s one-year chart tells the whole story. After getting stuck between $21 and $25 for months, shares exploded past $31 – that’s a 27% gain for the year and a massive 50% jump from recent lows. The technical setup was textbook: accumulation at support, volume-backed breakout above $28 resistance, then momentum buying that pushed it to new highs.

What Sparked the Rally

Three things came together perfectly. First, AI optimism finally started including Intel in the conversation about infrastructure plays. Second, management’s restructuring efforts and cost cuts started getting recognition. Third, the stock was just too cheap compared to competitors, attracting contrarian money looking for value.

This whole situation perfectly shows why you need to know whether you’re trading or investing. Investors are still worried about Intel’s ability to compete long-term in manufacturing and AI. They want to see actual execution before getting excited. Traders didn’t need any of that – they just needed liquidity, momentum, and a clean breakout pattern.

The big question now is whether Intel can actually deliver on the promise that’s driving this rally. Traders got their payday, but the stock’s future depends on whether the company can execute its turnaround and compete with the big players. As put it perfectly: “You must learn the difference between the two.”

Intel’s surge is a reminder that markets can change fast when technical and fundamental factors line up. Whether this momentum continues or fades will depend on execution, but for now, the traders who saw opportunity where others saw problems are counting their profits.