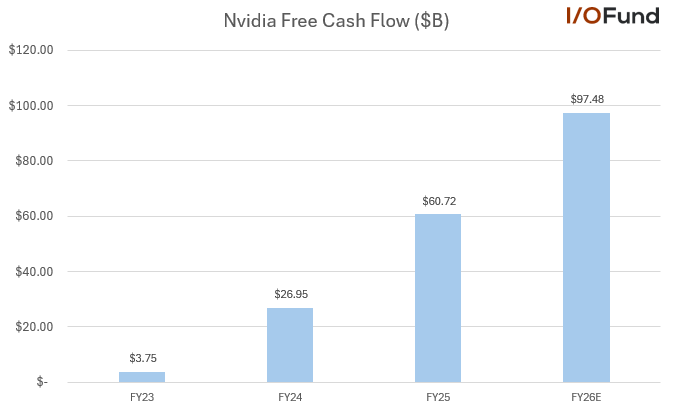

NVDA Price Target: Free Cash Flow to Hit $97.5B by FY26

Nvidia’s financial transformation tells one of the most compelling growth stories in modern tech. What started as a graphics chip company has evolved into the cornerstone of the AI revolution, with cash flows that reflect this dramatic shift. The numbers speak for themselves: from generating less than $4 billion in free cash flow just three years ago to projections approaching $100 billion by 2026.

Nvidia (NVDA) Price and Explosive Free Cash Flow Growth

The AI boom has catapulted Nvidia to tech sector leadership, but recent financial projections suggest we’re still in the early innings. Market strategist Beth Kindig recently pointed out that Nvidia’s free cash flow could jump from $3.75 billion in FY23 to nearly $97.5 billion in FY26—one of the steepest growth curves in tech history.

I/O Fund data shows the company’s cash generation accelerating dramatically: from $27 billion in FY24 to an expected $61 billion in FY25, before almost doubling again the following year. This isn’t just hype-driven growth—it represents a fundamental shift in Nvidia’s financial power.

Why This Matters for NVDA Price

For investors, massive free cash flow growth typically drives higher valuations. With nearly $100 billion in annual cash generation on the horizon, Nvidia gains unprecedented flexibility to fund R&D, expand share buybacks, and cement its dominance across AI, cloud computing, and autonomous technology.

While NVDA’s stock price already reflects significant optimism, fundamentals are outpacing even bullish expectations. Many analysts believe this cash flow trajectory could push the company’s valuation ceiling much higher.

Nvidia (NVDA) in Numbers

- FY23: $3.75B FCF

- FY24: $26.95B FCF

- FY25: $60.72B FCF (projected)

- FY26: $97.48B FCF (projected)

This explosive growth showcases Nvidia’s evolution from a GPU-focused company into a cash-generating powerhouse driving the AI revolution. While some warn about stretched valuations, the financial fundamentals suggest room for continued NVDA price appreciation.

Conclusion

With free cash flow approaching $100 billion by FY26, Nvidia continues setting new industry benchmarks. As Beth Kindig notes, this financial trajectory provides fuel for both future innovation and sustained stock price growth. The company’s transformation from graphics specialist to AI infrastructure leader appears far from complete.