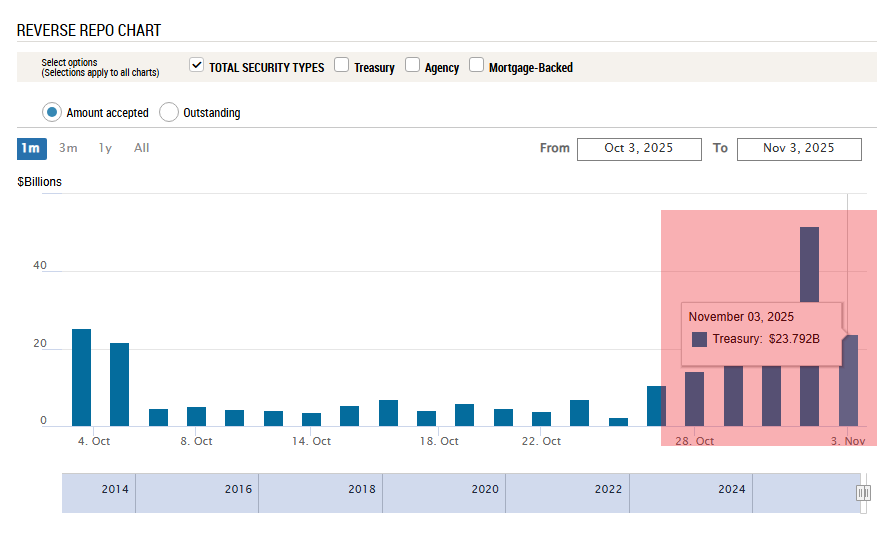

Fed Pumps $125B Into U.S. Banks in 5 Days

- The Fed just injected another $24 billion into U.S. banks on November 3, 2025, according to Barchart. That brings the five-day total to $125 billion—a clear signal that the central bank is working hard to keep short-term funding markets stable.

- Reverse repos are essentially short-term loans the Fed uses to manage liquidity and keep interest rates in check. The recent spike shows banks are leaning heavily on these operations, which could mean funding is getting tighter. While these injections calm things down temporarily, experts worry that too much reliance might reveal cracks in the system—similar to past repo market breakdowns.

- The upside? Better liquidity and steadier overnight rates. The downside? The Fed’s balance sheet keeps growing, and some economists think there are better ways to handle this—like tweaking reserve requirements or creating targeted lending windows—that wouldn’t fuel as much monetary expansion.

As Barchart put it: The Fed just did it again—another $24 billion injection into the U.S. banking system. Make that $125 billion over the last 5 days.

- The comment captures growing unease about what the Fed’s expanded intervention really means for the market. The timing isn’t random. Treasury issuance is up, and end-of-quarter pressures are squeezing money markets. After months of shrinking its balance sheet, the Fed is back to large-scale operations, showing the tricky balance between keeping markets stable and actually tightening policy. History tells us these kinds of spikes often come before major policy shifts or banking stress.

Pingback: S&P 500 Breadth Hits 3-Month Low as MAG7 Lead - Finly.News