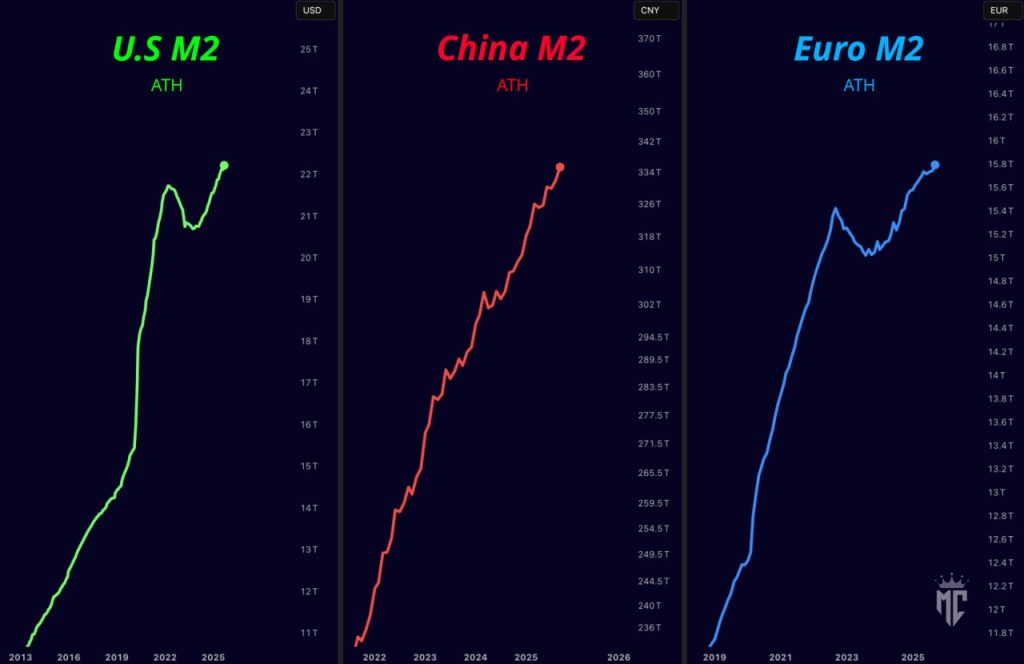

Global Money Supply Reaches New Highs as Bitcoin Narrative Strengthens

- Global money supply has accelerated dramatically, with the U.S. Federal Reserve’s M2, China’s liquidity base, and the Eurozone’s money supply all reaching new all-time highs. The synchronized expansion shows U.S. M2 above $22 trillion, China’s M2 exceeding 334 trillion CNY, and the Eurozone approaching €16 trillion—a clear signal that major economies are flooding the system with liquidity despite inflation concerns.

- The data reveals three converging trends. U.S. M2 has resumed climbing after briefly contracting in 2022–2023, suggesting a return to easier monetary conditions. China’s M2 continues its steady ascent as Beijing pumps credit into the economy to support growth. The Eurozone, after plateauing post-pandemic, has shifted back to expansion to prop up its struggling economy.

- This matters for markets. Historically, major M2 expansions have lifted risk assets across the board—stocks, commodities, and digital currencies. Bitcoin’s strongest bull runs in 2017 and 2020–2021 both followed massive liquidity injections. The pattern is consistent: when global money supply explodes, Bitcoin tends to follow as investors seek scarce assets and inflation hedges.

- With M2 at record highs across three major economic zones, traders are watching to see if Bitcoin will repeat its cyclical behavior—acting as both a store of value against monetary inflation and a magnet for excess liquidity in the financial system.

Source: Mister Crypto