US Taxes and Inflation: Why Many Believe Their Tax Burden Is “Too High”

Americans consistently tell pollsters they pay too much in taxes, but the numbers tell a more complex story. Gallup’s decades-long survey data reveals a fascinating disconnect: public frustration with taxes has surged since 2020 despite minimal changes to actual tax rates. The real culprit appears to be inflation and skyrocketing living costs that make every dollar feel more precious.

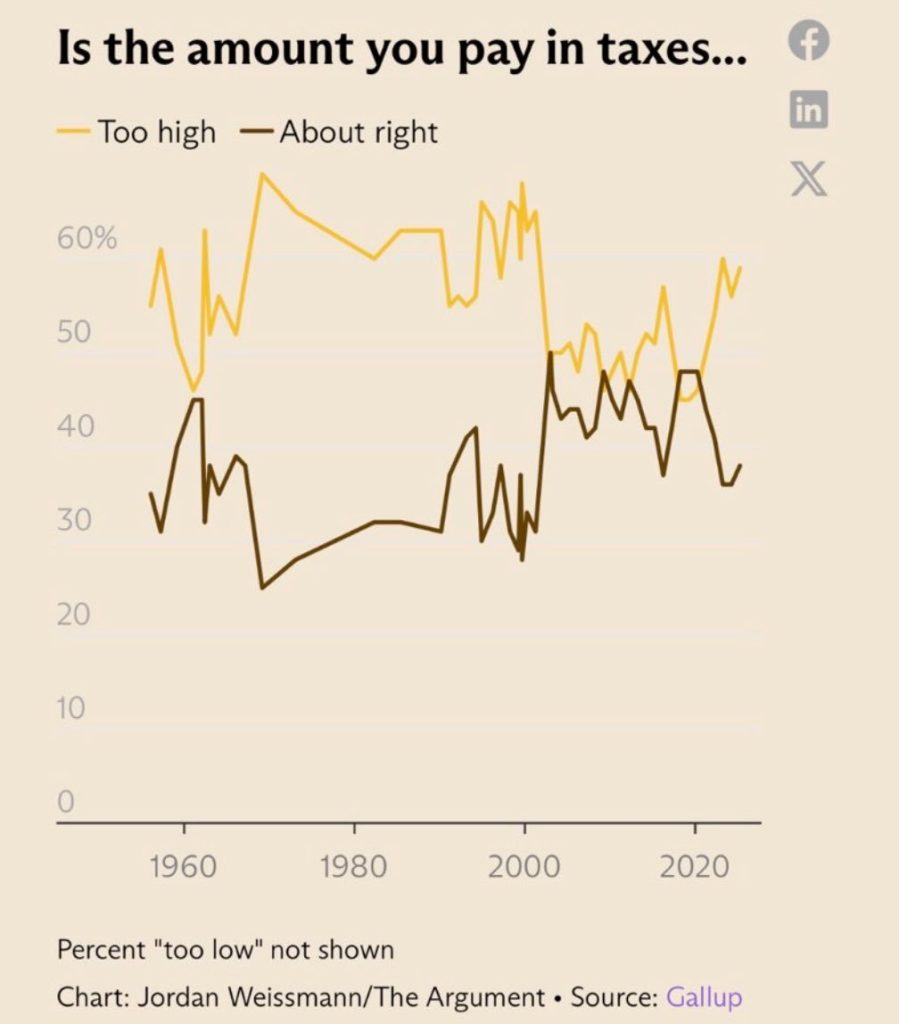

Gallup’s long-running survey shows that most Americans believe they pay “too much” in taxes, but the data suggests that inflation and rising costs are shaping perceptions more than actual tax hikes.

Inflation, Not Taxes, Drives Sentiment

The most telling observation comes from financial analysts who noticed something peculiar: complaints about taxes skyrocketed after 2020 without any corresponding tax hikes. Instead, this surge reflects how inflation chips away at purchasing power, making people feel like their tax burden has grown heavier.

The data tells the story clearly. Even without major tax law changes, over 55% of Americans now say their taxes are “too high,” while only about 30% believe they’re “about right.” It’s a classic case of economic psychology trumping fiscal reality.

The Lesson: Costs Must Come Down Before Taxes Can Go Up

This creates a political reality that policymakers can’t ignore: you can’t raise taxes when people are already struggling with basic expenses. Housing, healthcare, and groceries need to become affordable again before Americans will consider higher taxes reasonable.

This is where movements like YIMBY (Yes In My Backyard) become unexpectedly relevant to tax policy. By pushing for more housing supply to reduce living costs, these advocates are indirectly making the case for future tax discussions.

A Look at History

The historical pattern is revealing:

- 1960s: Americans were generally content, with more people saying taxes were “about right”

- 1980s–1990s: Economic turbulence pushed “too high” sentiment above 60%

- 2000s: Views balanced out, with both camps near 50%

- 2020–2025: Despite stable tax rates, inflation drove “too high” opinions back to 55-60%

This pattern shows that tax sentiment mirrors economic stress more than actual fiscal policy.

Conclusion

Gallup’s data reveals an important truth: what Americans call a “tax problem” is often really an inflation problem. Until policymakers address the cost of living crisis, tax debates will continue serving as a stand-in for broader economic frustration. The lesson for politicians is simple—fix prices first, then talk taxes.