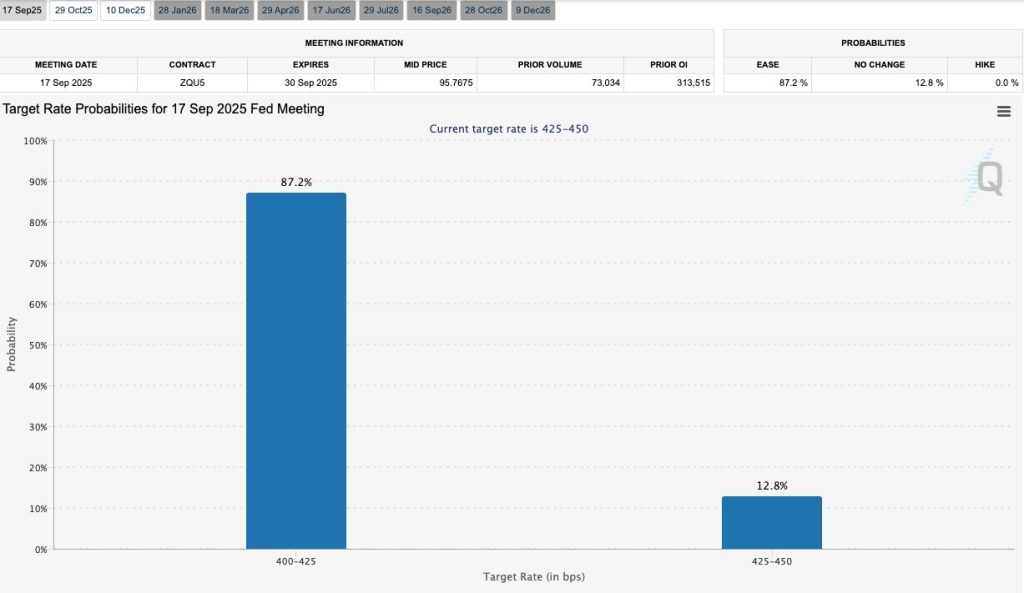

Market Sentiment Shifts as September Fed Cut Probability Hits 87.2% Following PCE Report

Wall Street just got the signal it’s been waiting for. The Federal Reserve’s next move is looking increasingly predictable after today’s PCE inflation data sent shockwaves through trading floors. What started as another routine economic report has morphed into a game-changing moment for monetary policy expectations. Traders are now scrambling to position themselves for what many believe will be the Fed’s first significant policy pivot in months, with crypto and risk assets leading the charge higher.

September Rate Cut Now Heavily Favored at 87.2%

The numbers from CME’s FedWatch tool paint a clear picture of market conviction:

- 87.2% chance the Fed slashes rates to the 400-425 basis point range on September 17, 2025

- 12.8% probability of maintaining current levels at 425-450 bps

- Zero expectation for any rate increases

This wasn’t a gradual shift in sentiment – it happened almost immediately after the PCE data crossed the wire. When you see this kind of decisive market movement, it usually means institutional money is making big bets on what’s coming next.

Why a Cut Would Boost Risk Assets

Fed rate cuts don’t happen in a vacuum – they tend to unleash a cascade of effects that risk asset traders know by heart:

Cheaper Money, Higher Prices: When the cost of borrowing drops, investment capital starts flowing toward higher-yield opportunities. That means crypto, growth stocks, and commodities suddenly look a lot more attractive.

Dollar Dynamics: A dovish Fed typically weakens the dollar, which historically benefits Bitcoin, Ethereum, and precious metals like gold. International investors start looking beyond traditional safe havens.

Psychology Matters: Beyond the technical factors, rate cuts signal that the Fed wants more risk-taking in the economy. That’s exactly the kind of environment where crypto rallies tend to take off.

What’s Next Before the Big Decision

Don’t assume this is a done deal just yet. While 87% odds are compelling, we’ve seen Fed expectations flip before when new data emerges. The key wildcards between now and September include:

- Any surprise inflation readings that could derail the easing narrative

- Employment data that might change the Fed’s calculus about economic strength

- Geopolitical developments that could influence policy decisions

Smart money will be watching Fed officials’ speeches closely for any hints about their thinking heading into the meeting.

Pingback: US Taxes and Inflation: Why Many Believe Their Tax Burden Is "Too High" - Finly.News