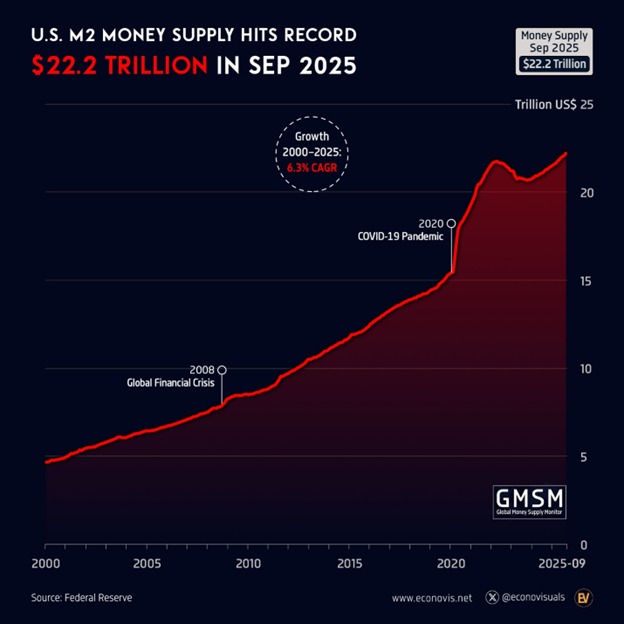

Inflation-Adjusted Perspective: Real Growth Resumes

- The U.S. money supply has hit a record $22.2 trillion, but what’s more telling is what’s happening beneath the surface. When you strip out inflation, M2 is growing in real terms for the first time in over a year—meaning there’s more actual purchasing power sloshing around the economy. That shift matters, especially for anyone trying to figure out where to put their money in an era of persistent inflation and structural liquidity expansion.

- When you adjust for inflation, M2 grew +1.4% year-over-year in the latest data—marking the 13th straight month of positive real growth. That means liquidity is expanding faster than consumer prices again, which suggests monetary policy is still stimulative in real terms, even after all those rate hikes.

- This combo of rising liquidity and cooling inflation has historically been good news for asset prices—stocks, commodities, and alternatives like Bitcoin and gold tend to perform well in these conditions. It’s why.

- The Kobeissi Letter line, “Own assets or be left behind,” has struck a chord with investors looking to protect their purchasing power in a world where inflation isn’t going away. What’s driving this? A lot of it comes down to fiscal policy. High federal deficits, ongoing government borrowing, and spending programs have all fed into the continued rise in broad money. Even as the Federal Reserve shrank its balance sheet, Treasury issuance and other financial mechanisms kept capital flowing through the system.

- This points to a bigger shift: money supply growth isn’t cyclical anymore—it’s structural. It’s less about short-term Fed moves and more about long-term fiscal realities. The $22.2 trillion M2 figure isn’t just a number; it reflects a fundamental change in how the U.S. economy operates. We’ve moved from periodic liquidity cycles to something more like permanent expansion, fueled by crises, stimulus, and systemic fiscal needs.

- Inflation may be subdued for now, but the underlying liquidity trend suggests that owning real assets—things that hold value as money supply grows—could become increasingly important in the years ahead.