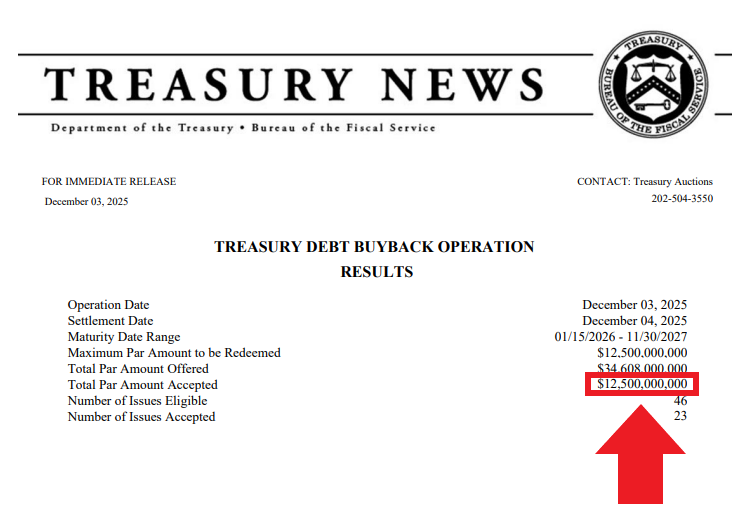

U.S. Treasury Completes Record $12.5 Billion Debt Buyback

- The U.S. Treasury just made history with its largest-ever debt repurchase, buying back $12.5 billion in outstanding securities on December 3. The operation focused on notes maturing between January 2026 and November 2027, part of a renewed push to manage market liquidity and smooth out the federal debt repayment schedule.

- Here’s what went down: Treasury offered to buy back 46 eligible issues, and bondholders responded with $34.6 billion in offers. The Treasury picked through those submissions and accepted $12.5 billion across 23 different issues—hitting the maximum redemption limit they’d set for this round. The strong turnout shows plenty of market players were ready to cash out early.

By retiring debt earlier in its lifecycle, the Treasury can reduce pressures on specific maturity segments while creating more flexibility in future issuance cycles.

- This isn’t just about big numbers. The timing matters. Bond market liquidity has been under the microscope lately as the government juggles massive borrowing needs. By buying back bonds before they mature, Treasury takes pressure off certain parts of the market and gives itself more room to maneuver when issuing new debt down the road.

- The move signals something bigger too—Treasury is getting more hands-on with how it manages the debt pile. Operations this size can ripple through the entire yield curve, potentially smoothing out trading conditions and shifting how investors think about future funding strategies. Now that the record’s been set, traders will be watching closely to see if more big buybacks are coming and what that means for the broader fixed income landscape.

My Take: This $12.5 billion buyback shows Treasury is taking liquidity management seriously. It’s a smart play to ease pressure on near-term maturities while giving flexibility for future issuance. If this becomes the new normal, we could see smoother trading conditions across the curve.

Source: Barchart