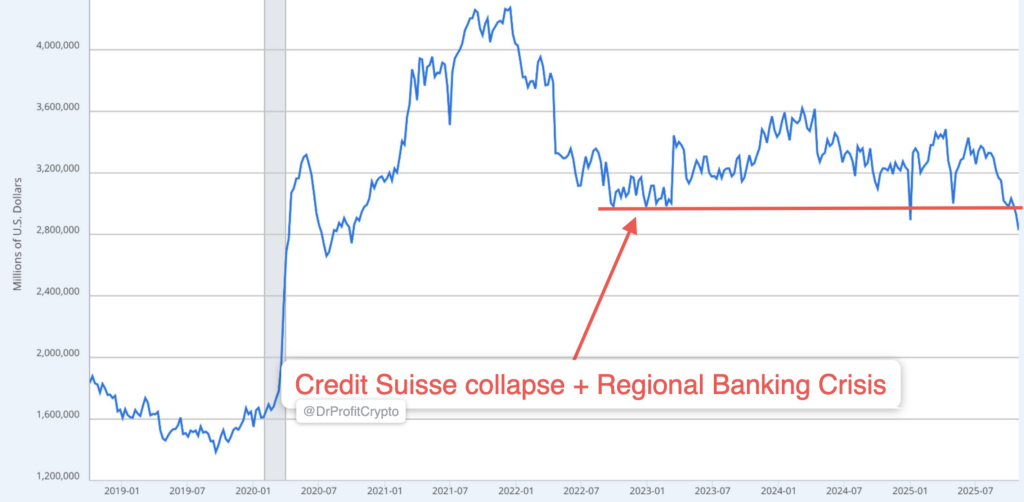

Bank Reserves Drop Below 2023 Crisis Levels

- U.S. bank reserves are now sitting below the levels recorded during last year’s regional banking crisis — when Credit Suisse went under and several American banks faced serious liquidity problems. According to Doctor Profit, the latest data shows reserves falling beneath the $2.8 trillion mark, the same threshold that sparked widespread alarm across the sector in 2023.

- This drop matters because bank reserves — essentially the cash banks park at the Federal Reserve — serve as a crucial safety net for the entire system. When they get too low, even small funding hiccups can snowball into bigger problems, just like we saw when multiple mid-sized banks failed in quick succession two years ago. Doctor Profit warns that “banking stress is close,” with liquidity getting tighter again.

- Lower reserves don’t just affect banks. They squeeze lending capacity, push up borrowing costs, and make credit harder to get for everyone from homebuyers to small businesses. If this continues, the Fed might need to pump the brakes on its quantitative tightening program, which has already pulled over $1 trillion out of the system since 2022. Reversing course could stabilize things, but it risks firing up inflation again — the same tough choice policymakers faced last time around.