Crypto News: Prediction Markets See Parabolic Surge

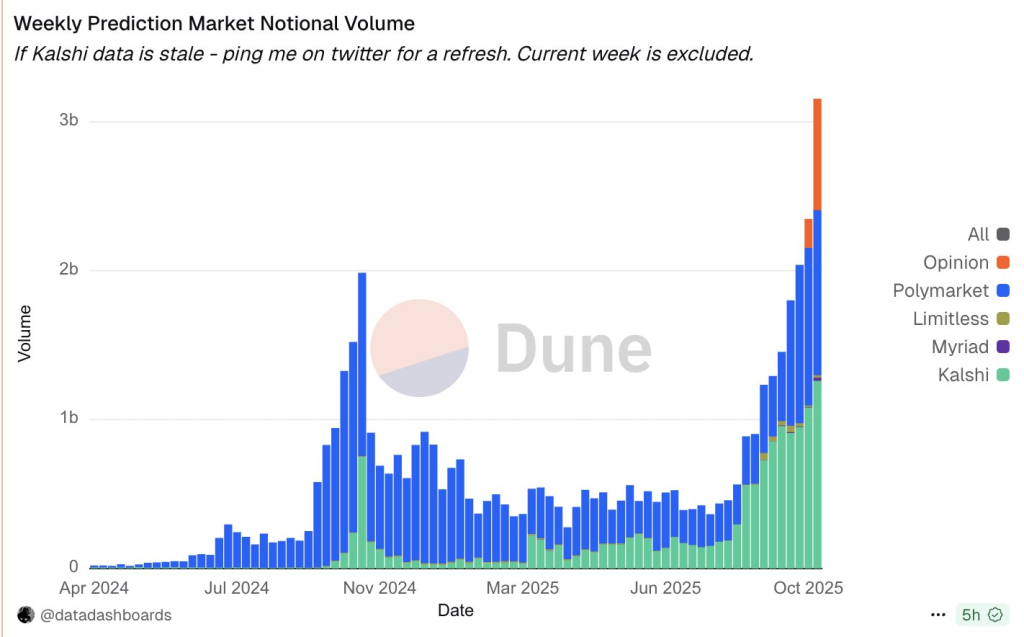

- Prediction markets are experiencing explosive growth, with weekly trading volumes going parabolic across leading platforms. Crypto analyst CryptoGoos recently pointed out this dramatic surge, emphasizing that these numbers represent “real money, not fake polls”—making prediction markets one of the most reliable real-time indicators for major events.

- Combined weekly volumes across Polymarket, Kalshi, Opinion, Limitless, and Myriad have now topped $3 billion, marking an acceleration unlike anything seen earlier in 2025. This spike reflects genuine user demand for platforms where people can put money behind their forecasts, creating what many see as more accurate signals than traditional polling.

- As these platforms grow, regulators are starting to pay attention. Policymakers are exploring crypto tax reforms, with particular focus on high-velocity sectors like prediction markets. Industry leaders warn that overly strict compliance requirements could trigger bankruptcies and push talent overseas, potentially stifling one of crypto’s most innovative areas.

- The debate centers on finding the right balance. While governments worry about lost revenue if tax frameworks don’t adapt to digital-economy models, industry groups suggest profit-based taxes rather than transaction levies would better support innovation while ensuring stable government income.

- There’s also a broader structural question: because prediction platforms generate massive transaction volume with small teams, they’re shifting taxable activity away from traditional labor-intensive industries—a trend that could reshape employment patterns and tax bases over time.

- As crypto regulation continues evolving, prediction markets look set to become one of the most influential sectors in digital finance.