Debt News: US Household Borrowing Hits Record High

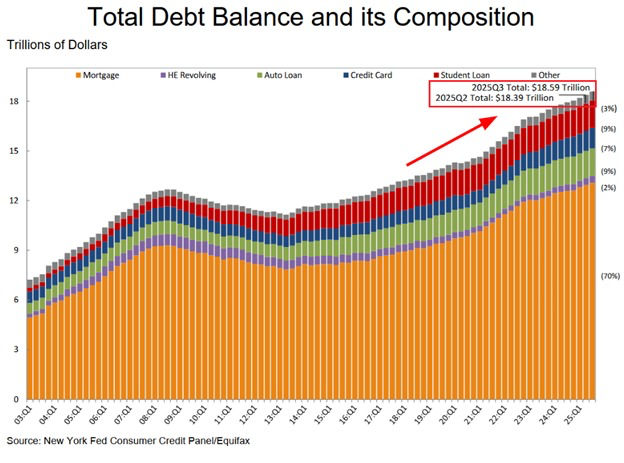

- US households added $197 billion in debt during Q3 2025, bringing total borrowing to an all-time high of $18.59 trillion, according to The Kobeissi Letter. Over the past year alone, debt has grown by $642 billion, and lawmakers are questioning whether current policies can keep pace with this level of consumer leverage.

- The biggest driver? Mortgages, which rose $137 billion to reach $13.07 trillion. Credit card debt hit $1.23 trillion, while student loans climbed to $1.65 trillion. Together, these numbers paint a picture of mounting financial pressure on American families.

- Some legislators are now floating tax proposals aimed at slowing debt growth. Their concern is that too much leverage could trigger a wave of bankruptcies and deepen financial inequality. There’s also talk of targeting high-margin lenders rather than imposing broad tax hikes, framing it as a fairer approach.

- The worry isn’t just about households. If debt keeps rising while wages stagnate, analysts say the federal budget could take a hit. Defaults or reduced spending would cut into tax revenue, especially from income taxes, even as corporate profits from lending activity climb.