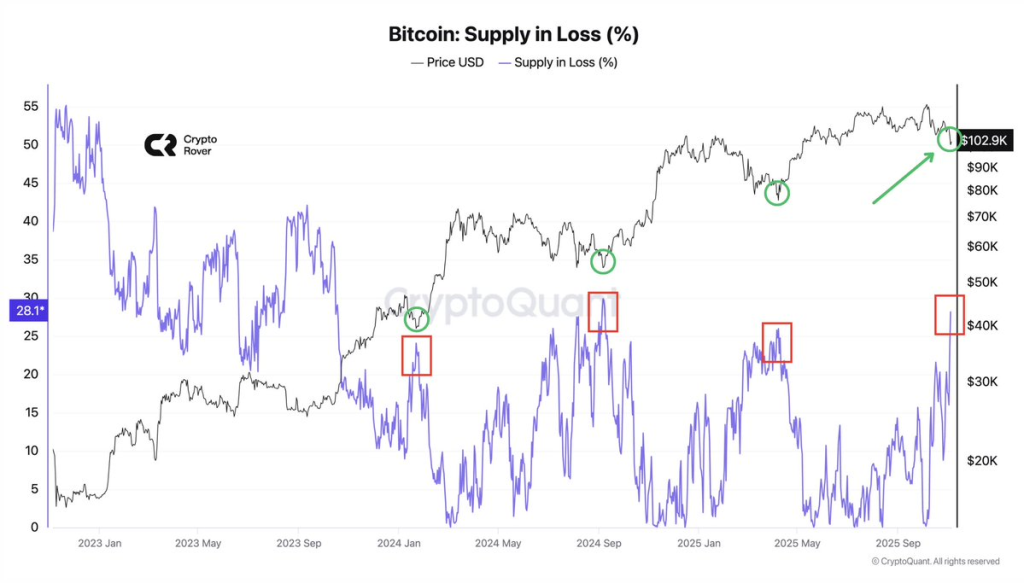

Bitcoin Coin News: Loss Supply Spike Signals Market Bottom

- Analyst Crypto Rover recently pointed out a sharp jump in Bitcoin supply currently sitting at a loss, with the metric reaching levels not seen since 2024. Similar spikes in unrealized losses have typically marked the final stages of market capitulation and often come right before major bottoms. This is happening while policymakers debate tax reforms targeting crypto mining, raising questions about how these extreme market swings might clash with new regulations.

- The proposed mining tax changes—designed to steady government income—come with real risks. Hitting smaller mining operations with higher taxes during a downturn could force bankruptcies or drive talent out of the sector entirely. With Bitcoin’s underwater metrics spiking, regulators worry that poorly timed taxation could pile financial stress on miners when they’re already struggling.

- On the revenue side, governments are concerned that outdated crypto tax rules could lead to unpredictable budget swings. Since mining profits rise and fall dramatically with Bitcoin’s price, tax revenue tied to corporate activity and energy consumption becomes unreliable. Industry advocates argue that taxing actual profits instead of upfront operational costs would better reflect real earnings and protect public revenues during deep downturns—like right now.

- The tax reform discussion also touches on longer-term impacts on jobs and personal income tax revenue. As mining gets harder and profit margins shrink, regional payrolls drop, cutting income tax collection even while corporate profits boom during bull runs.