BlackRock Leads Tokenized Treasury Market

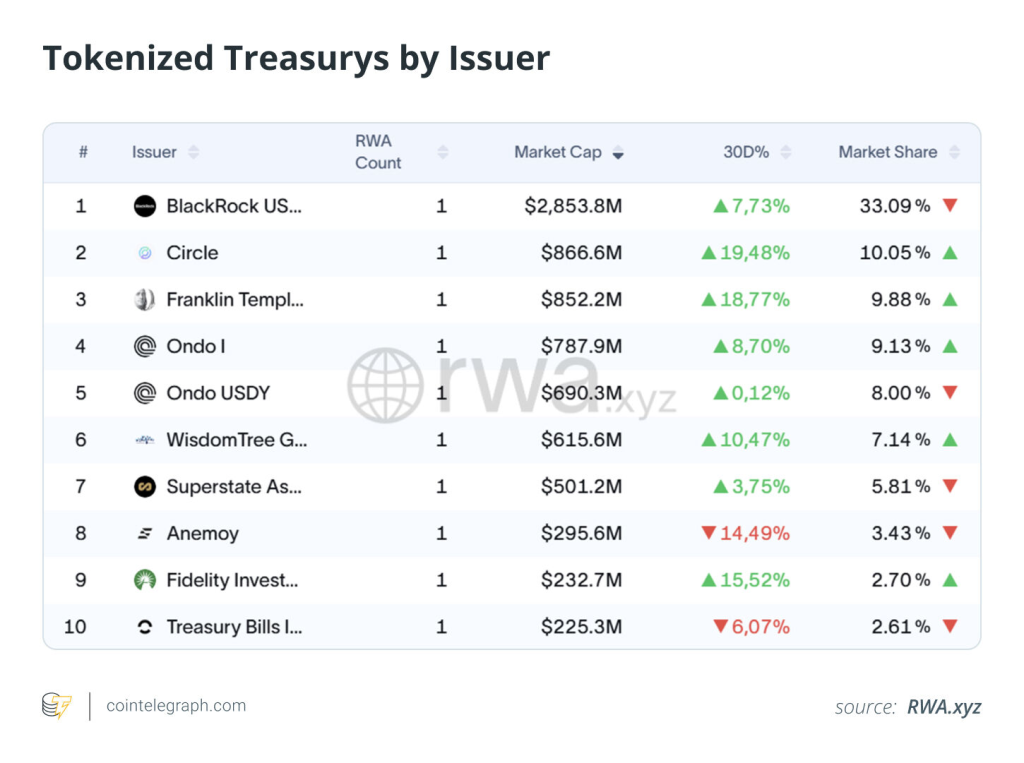

- BlackRock’s BUIDL fund still leads the tokenized treasury space with a 33% market share, according to RWA.xyz data cited in a recent Cointelegraph report. But the race is heating up—traditional finance heavyweights like Franklin Templeton, Circle, and Ondo Finance are pushing hard into tokenization, slowly chipping away at BlackRock’s dominance.

- Circle has hit a market cap of $866.6 million (up 19.48% in 30 days), while Franklin Templeton’s tokenized offering reached $852.2 million (up 18.77%). Ondo Finance now controls over 17% of the market through its Ondo I and USDY products. Together, these players show how institutions are racing to bring traditional yield products like U.S. Treasuries onto the blockchain—bridging regulated finance with crypto infrastructure.

- Still, the market faces real structural challenges. Most products remain accessible only to Qualified Purchasers, locking out everyday investors. Redemptions still follow traditional banking hours, limiting the liquidity advantages blockchain is supposed to deliver.

- These barriers show up in pricing too. Tokenized treasuries trade at roughly a 10% discount on secondary exchanges, compared to just 2% spreads in traditional repo markets. That gap reflects how early-stage this ecosystem still is.

- Despite these growing pains, tokenized treasuries have become one of the strongest real-world asset (RWA) success stories. The market has surpassed $8 billion in total capitalization, signaling serious institutional momentum and appetite for compliant, yield-generating blockchain products.