Bitcoin Treasury Demand Crashes 90%

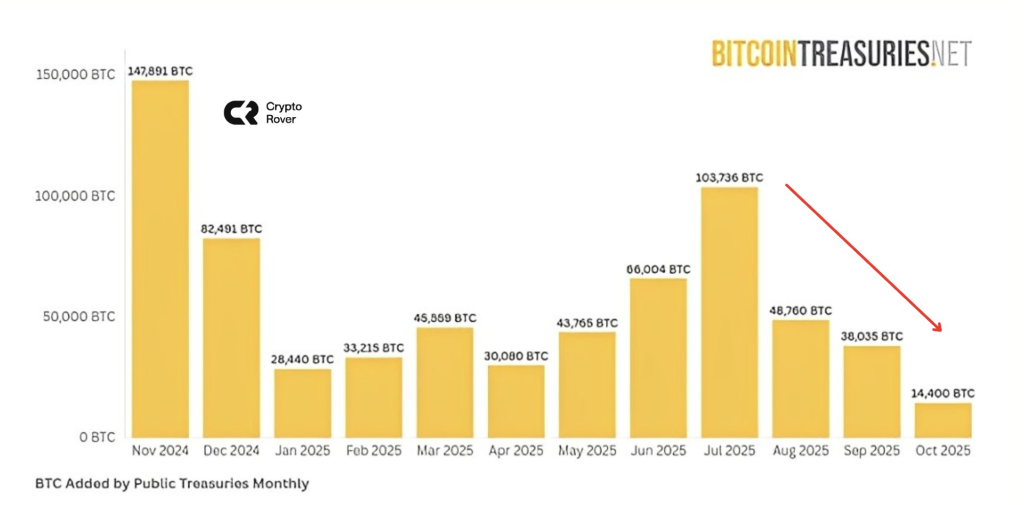

- Crypto Rover recently raised alarms about Bitcoin treasury demand “falling off a cliff,” citing fresh data from BitcoinTreasuries.net that shows a major slowdown in how much Bitcoin companies are buying. The numbers tell a stark story: public companies added only 14,400 BTC to their books in October 2025, compared to 147,891 BTC in November 2024. That’s a massive 90% drop in corporate Bitcoin purchases in less than a year.

- This pullback carries real risks. When big institutions stop buying, the market loses one of its main stabilizing forces. Corporate treasury buying used to act as a safety net against wild price swings and showed that companies believed in Bitcoin as a long-term asset. But now things have changed. Companies are dealing with expensive borrowing costs, stricter regulations, and shrinking profits in the crypto space, which is making them think twice about loading up on Bitcoin.

- The market has already felt the impact. Bitcoin’s recent price slide seems directly tied to companies backing away. Without steady buying from corporate treasuries, there’s less liquidity and momentum, which lets speculative selloffs hit harder.

As Crypto Rover put it, “One of the main reasons we’re seeing this dump” is that the institutional demand that used to drive Bitcoin’s rallies has dried up.

- Looking at the bigger picture, this retreat shows how much macroeconomic factors and monetary policy now control crypto flows. Back in late 2024 and early 2025, corporate treasuries were adding 60,000 to 150,000 BTC every month, helping push Bitcoin toward its peak prices. But the second half of 2025 has been a different story, with consistent declines leading to the weakest monthly inflows we’ve seen all year.

- Analysts think this might be a temporary shift rather than a permanent exit. If inflation settles down and borrowing gets easier, institutional buyers could come back, possibly setting up renewed accumulation in 2026. But right now, Bitcoin’s treasury demand is one of the clearest warning signs of short-term market weakness.