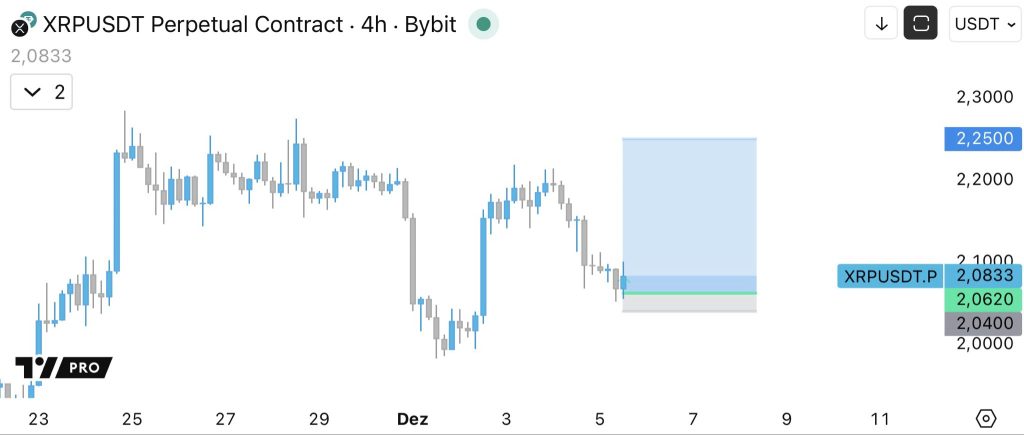

XRP Holds Above $2.08 as Stop Level Tightens to $2.04

⬤ XRP stayed steady near the $2.08 mark on the 4-hour chart, maintaining its ground after recent momentum shifts. The position hit a 1R gain, leading to a strategic move that raised the stop level to $2.04 to cut risk while keeping the trade alive. The chart shows XRP trying to establish support at the lower edge of its current range.

⬤ Recent price action reveals a measured pullback followed by stabilization, with XRP bouncing between $2.06 and $2.09 after a wider retreat earlier this week. The tightened stop at $2.04 shows a more cautious approach that matches the consolidation pattern playing out on the chart. A significant upside zone sits above, mapping out the potential route if buyers step back in with force.

“The position has reached 1R, so I’m raising the stop to 2.04 to manage risk while staying in the trade.”

⬤ XRP’s current setup mirrors what’s happening across major altcoins, with many stuck in similar mid-range compression after quick upward bursts. The lower support zone indicates buying interest is coming back near the setup’s base, backing the decision to stay in while trimming exposure. With overhead resistance and support holding firm, XRP trades in a structured but uncertain short-term zone.

⬤ This matters because risk tweaks during early trade stages often point to better structure and shrinking downside potential. XRP staying above $2.06 shapes what comes next, determining whether momentum pushes into the higher target area or the market stays sideways waiting for fresh triggers.

My Take:

XRP’s ability to hold above $2.08 while tightening risk shows smart trade management in choppy conditions. The $2.04 stop gives breathing room without overexposing to a breakdown, and the consolidation pattern suggests accumulation.

Source: Muro