S&P 500 Breadth Hits 3-Month Low as MAG7 Lead

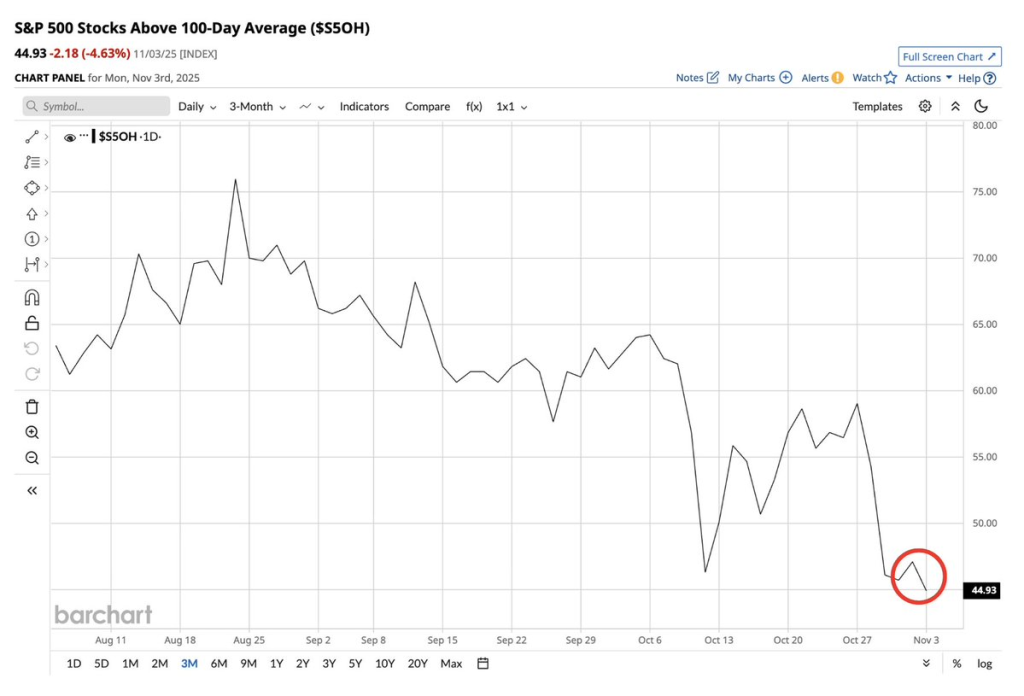

- Crypto Rover recently pointed out a worrying trend in U.S. market breadth: fewer S&P 500 stocks are staying above their 100-day moving average. As of November 3, 2025, only 44.93% of stocks remain above this technical marker — the lowest in three months and down 4.63% in just one day.

- What this really means is that while the S&P 500 looks healthy on the surface, most individual stocks aren’t joining the party. The index is being propped up by the “Magnificent Seven” — Apple, Microsoft, Amazon, Alphabet, Nvidia, Meta, and Tesla. When gains are this concentrated, analysts get nervous. If these tech giants stumble, the whole market could take a harder fall. This narrow leadership also makes things riskier for related markets like crypto.

- When fewer stocks trade above key moving averages, it usually hints at weakening momentum. Big money managers often see this as a signal to rotate out of stretched tech stocks and into cheaper cyclical or defensive plays. Some strategists, though, view it as a healthy pullback that could set up the next buying opportunity once breadth improves. Either way, diversification matters more than ever as we head into late-cycle territory.

As Crypto Rover put it: “The percentage of U.S. stocks trading above their 100MA is at a three-month low. Most gains are driven by the MAG7, which could explain why crypto isn’t catching up as much.”

- His take suggests that when money piles into a handful of mega-cap stocks, there’s less appetite for speculative bets in crypto and elsewhere. We’ve seen this movie before — in mid-2022 and late-2023, smaller stocks struggled while big tech kept winning. With inflation cooling but rate cuts still up in the air, investors are wondering if this rally can spread beyond tech or if we’re due for a correction before year-end.