SOL Price Analysis: $SOL Shows Signs of Bottoming as 2-Week Capitulation Deepens

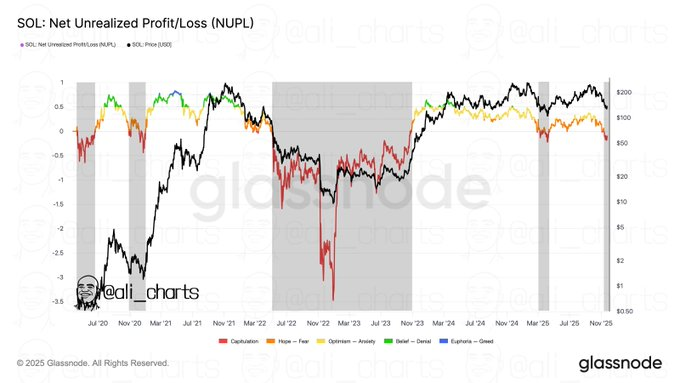

- Solana is flashing potential signs of a market bottom as its Net Unrealized Profit/Loss metric sinks deeper into capitulation territory. The NUPL data shows investors have been capitulating for two straight weeks, creating a pattern that looks strikingly similar to previous low-point phases in Solana’s history. The indicator has flipped negative, showing unrealized losses piling up across the network.

- The Glassnode chart reveals several past instances where negative NUPL readings lined up with major turning points for $SOL. During cycles in late 2020, mid-2022, and early 2023, capitulation signals tracked closely with depressed prices before momentum eventually reversed. Right now, the NUPL behavior is mirroring those earlier phases, with the metric sitting firmly in the red while Solana trades near the bottom of its recent range.

The current capitulation shown in Solana’s data highlights a potentially pivotal sentiment shift that may shape the next stage of the broader market environment.

- The chart tracks how sentiment moves through stages like hope, fear, anxiety, and finally capitulation, where unrealized losses take over. In the latest readings, Solana’s NUPL has clearly entered that capitulation zone. This means a significant portion of holders are underwater on their positions, matching historical market stress conditions. The extended drawdown periods shown on the chart confirm these phases typically last a while before stabilizing.

- This matters because capitulation often comes with broader market resets. When unrealized losses mount and sentiment weakens, price action can consolidate into a base for future trend reversals. While NUPL alone can’t confirm a bottom, the current capitulation in Solana’s data points to a potentially important sentiment shift that could set up the next phase of price action.

My Take: The 2-week capitulation window is significant because it shows sustained pressure rather than a quick shakeout. If history repeats, we could be witnessing the formation of a bottom that sets the stage for $SOL’s next major move upward.

Source: Ali