BNB Coin News: Price Holds $872 Support After Pullback From $893 Resistance

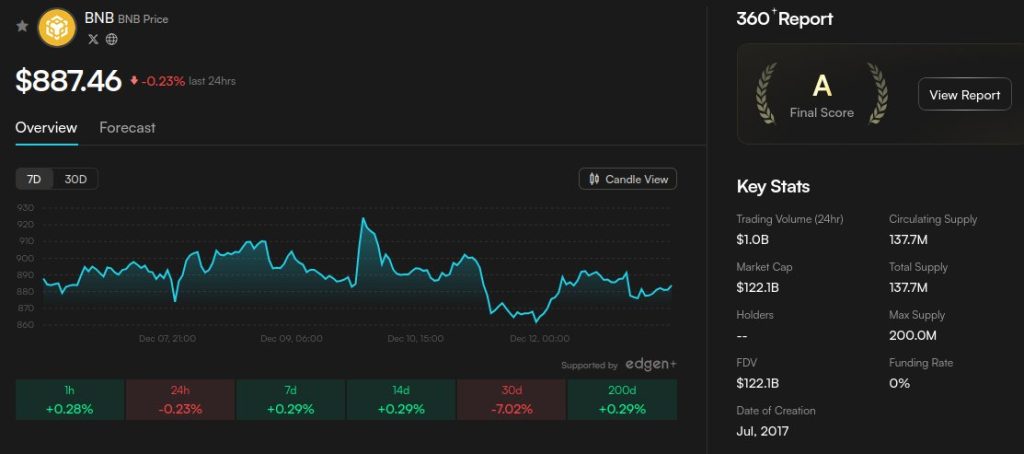

- In a recent market update, BNB Coin is trading at $887.46, posting a 0.23% decline over the past 24 hours. BNB moved lower after hitting resistance near $893.65, leaving the price near the bottom of today’s trading range as momentum softened.

- The short-term picture reflects modest selling rather than aggressive distribution. Market capitalization declined by roughly $301 million, matching the 0.23% daily drop, while 24-hour trading volume of about $1.0 billion points to steady but not elevated activity. This combination suggests that sellers have gained limited control, without triggering heavy liquidation. The chart also highlights a key support zone between $872 and $875, which has so far remained intact and continues to anchor price action.

BNB is trading near the lower end of today’s range after hitting resistance at $893.65. Support around $872–$875 appears to be holding, but if this level breaks, the next notable downside target could emerge near $850.

- Supply metrics provide additional context. BNB Coin currently has a circulating supply of 137.7 million tokens, compared with a maximum supply of 200 million, leaving a sizable gap that factors into longer-term valuation discussions. Despite the current pullback, BNB remains dramatically higher than its historical levels, up more than 2.2 million percent from its all-time low near $0.0398, underscoring the scale of its long-term appreciation.

- With resistance still defined near $893.65 and the $900 psychological level, near-term price behavior is likely to remain closely tied to these clearly marked technical zones across the broader crypto market.

My Take: BNB’s ability to hold the $872-$875 support zone despite rejection at resistance shows underlying strength. The $1B volume without panic selling suggests consolidation rather than distribution. Watch for a retest of $893—a clean break could open the path to $900+.

Source: Zeru