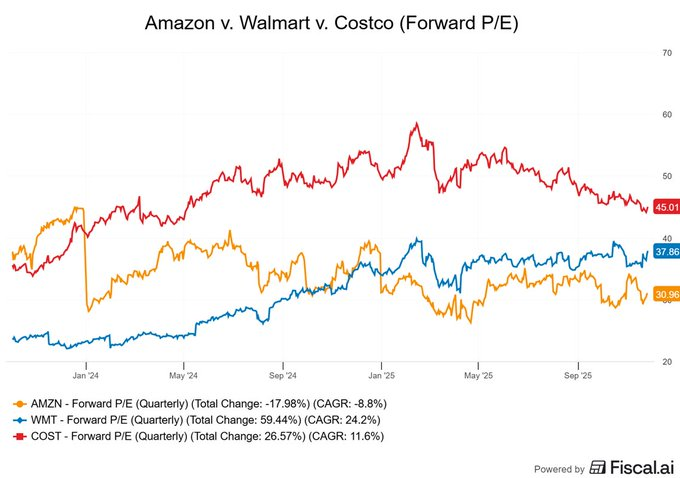

Amazon’s Forward P/E Drops 18% While Walmart Rises 59%

- A fresh valuation analysis reveals a striking disconnect between Amazon, Walmart, and Costco. While debate continues over whether Amazon is overvalued given its massive logistics network, booming ad business, and cloud dominance, the numbers tell a different story. Amazon’s forward P/E has been sliding downward, while Walmart and Costco have climbed significantly higher.

- The data shows Amazon’s forward P/E dropped nearly 18 percent to around 30.9. Meanwhile, Walmart’s multiple jumped roughly 59 percent, hitting about 37.86. Costco also saw strong growth, with its forward P/E rising approximately 26 percent to 45.01. The trend lines make it clear—Amazon’s valuation has been heading south while the other two maintain premium levels.

Amazon operates one of the most advanced logistics networks globally and leads in point-of-purchase advertising.

- What makes this divergence particularly interesting is Amazon’s business mix. The company runs one of the world’s most sophisticated logistics operations, dominates digital advertising at the point of purchase, and generates substantial profits through Amazon Web Services. Yet despite these strengths, the market is pricing it at a discount compared to its brick-and-mortar competitors.

- The widening gap between these retail titans reflects changing investor sentiment. Costco now commands the highest valuation of the three, while Walmart’s multiple continues climbing. Amazon’s relative decline stands out sharply against this backdrop. These shifts could reshape expectations around retail, cloud infrastructure, and consumer spending as Wall Street reassesses which business models deserve premium pricing.

My Take: The valuation gap seems odd when you consider Amazon’s diversified revenue streams and tech infrastructure. The market may be underestimating AWS’s pricing power and the advertising segment’s growth potential.

Source: Shay Boloor