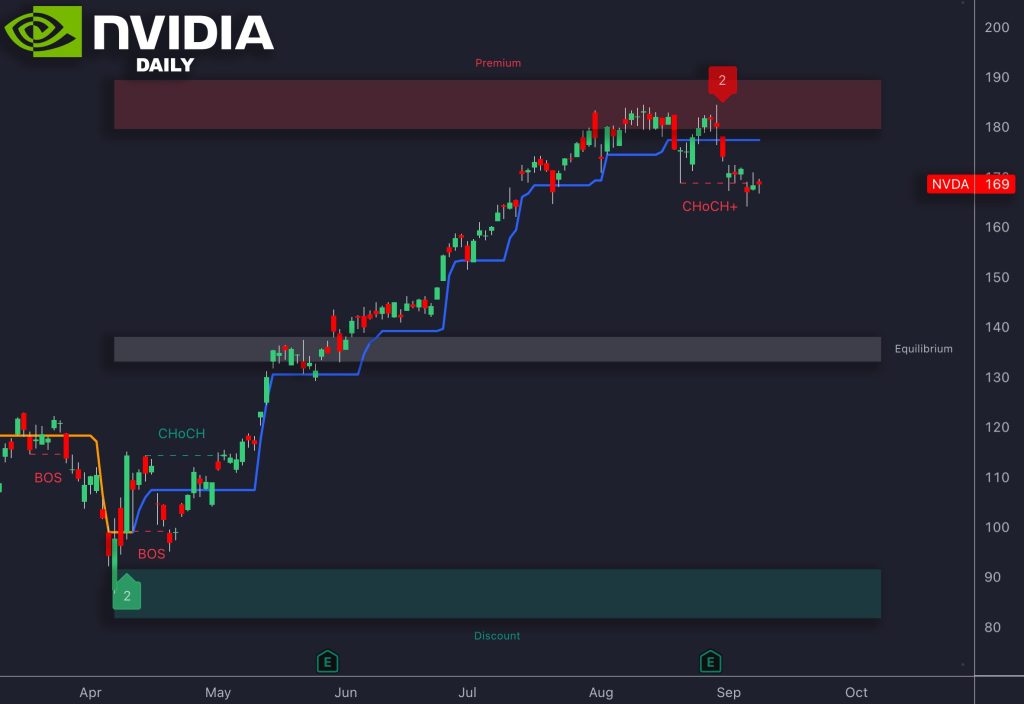

Nvidia’s Second 2025 Crash: History About to Repeat?

Nvidia’s having one of those moments that make traders nervous. The AI darling just broke into another bearish formation that looks eerily similar to what hammered the stock earlier this year. Back then, NVDA got obliterated for more than three months straight. Now the question everyone’s asking is simple: are we about to watch it happen again?

The Technical Breakdown That Has Everyone Worried

LuxAlgo’s calling it like they see it – Nvidia’s chart just flashed a “change of character” signal around that crucial $180-$190 zone where sellers have been waiting. The stock tested that resistance, got rejected hard, and dropped to $169. That’s textbook bearish momentum taking over.

What makes this scary is how closely it mirrors the earlier 2025 setup that wiped out over a third of NVDA’s value. The pattern’s playing out almost identically, suggesting we could be in for weeks of pain unless something dramatic changes.

- Premium Zone ($180-$190): This is where sellers are camping out, and they’re not budging

- Equilibrium Zone (~$140): Where the stock could land if things get ugly

- Discount Zone (~$90): The nightmare scenario that aligns with major retracement levels

Right now, NVDA’s trading below that premium resistance, which means the bears are calling the shots.

Why Even the AI King Isn’t Safe

Here’s the thing about Nvidia – the fundamentals are still rock solid. AI demand is through the roof, and their GPU dominance isn’t going anywhere. But the market doesn’t always care about fundamentals when technical patterns start screaming sell signals.

The reality is that profit-taking hit hard after those massive AI-driven rallies. Add in some valuation concerns, higher yields making growth stocks less attractive, and sector rotation pulling money elsewhere, and you’ve got a perfect storm for technical weakness.