Cardano Holders Strengthen Their Grip as ADA Price Stabilizes

Cardano’s most dedicated investors aren’t budging. While markets swing wildly, long-term ADA holders – especially those who’ve been around since 2021 – keep adding to their stacks instead of cashing out. This behavior is creating some interesting dynamics that could shape ADA’s next move.

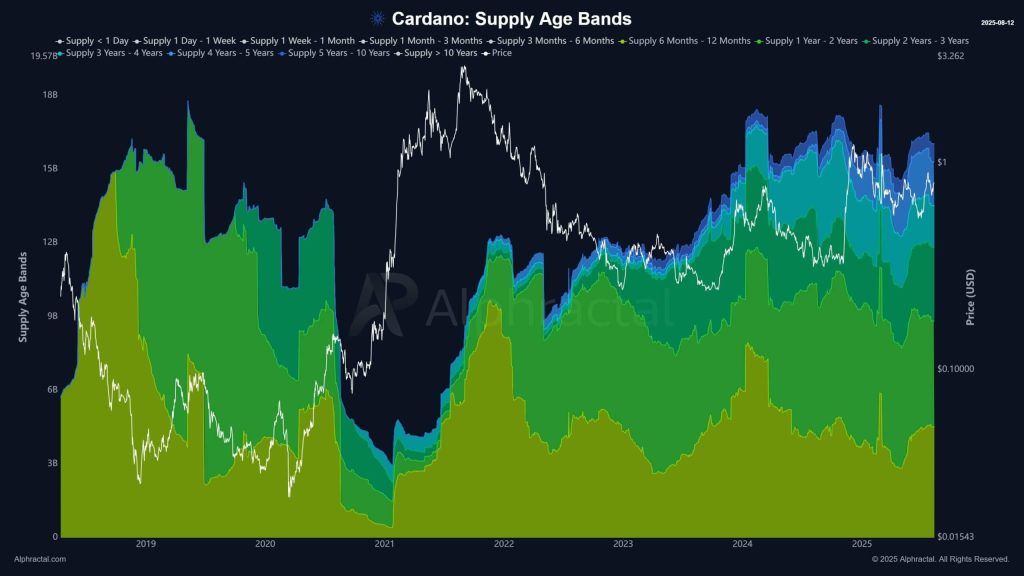

Supply Age Bands Tell the Story

TapTools data reveals something striking about ADA distribution. Most of the supply has been sitting untouched for years, even during major rallies when you’d expect profit-taking. The biggest accumulation happens in these time frames:

- 6 months to 3+ years: These bands dominate total supply

- Under 1 month: Represents just a small slice of activity

- Older cohorts: Keep expanding despite 2022-2025 volatility

This pattern shows ADA is moving from speculators to believers. When prices dip, these holders see opportunity rather than danger.

What This Means for Price Action

ADA still trades well below its $3.26 peak from 2021, but all this long-term accumulation creates a floor. With less selling pressure from committed holders, any new buying interest could have outsized impact. The data shows that even during tough market periods, older supply groups kept growing – people were buying the dips, not running for the exits.

This concentration of diamond hands cuts both ways though. If sentiment turns positive, limited sell pressure could fuel faster rallies. But ADA still needs to break back above $1 and hold it to prove this accumulation phase is paying off. The technical setup looks interesting, but execution matters more than hodling patterns when it comes to sustained price recovery.