ETH Price Analysis: Ethereum Nears Potential Local Bottom Around $2,900

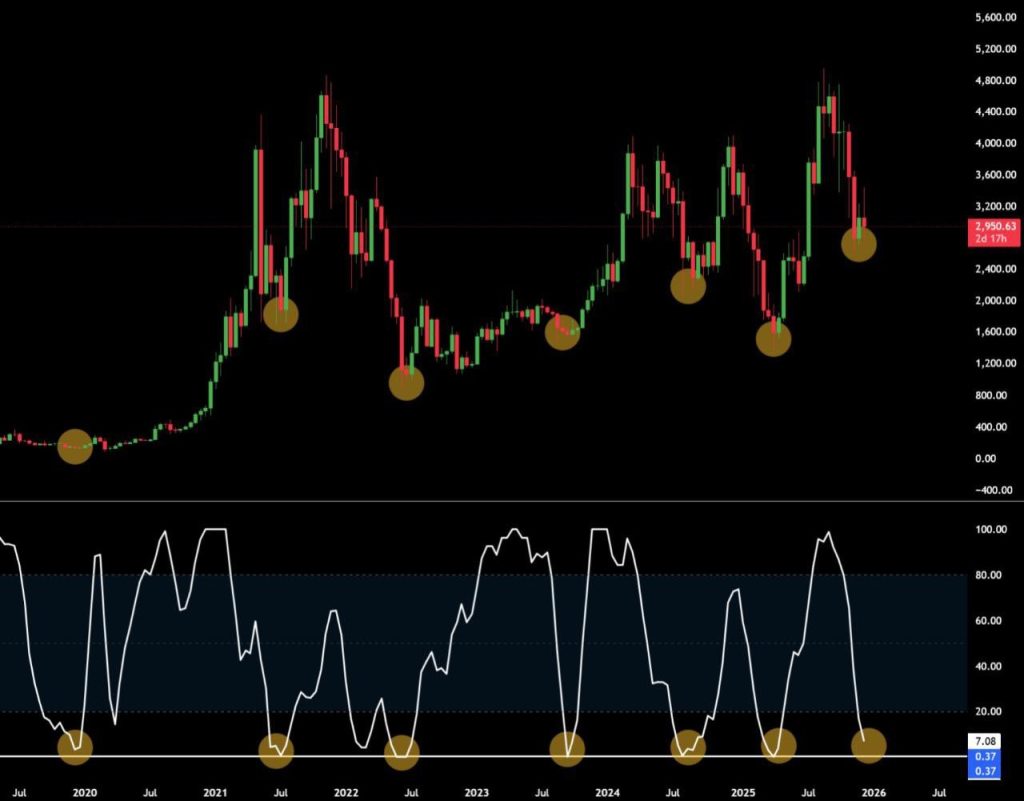

Ethereum is showing signs that a local bottom may be forming following its recent decline. ETH appears to be either at a local low or just a few candles away from one. The chart highlights recurring historical patterns where similar price behavior preceded periods of stabilization or recovery.

The image shows Ethereum pulling back sharply from previous cycle highs before finding support zones that have repeatedly acted as local bottoms in past market phases. Several highlighted points on the price chart mark moments where downward momentum slowed and price began to consolidate. Currently, ETH is trading near the $2,900 area, a zone that visually aligns with prior consolidation levels.

“ETH appears to be either at a local low or just a few candles away from one, based on recurring historical patterns that have preceded stabilization phases.”

The lower indicator panel shows an oscillator reaching deeply oversold conditions, a pattern consistently observed near previous Ethereum local bottoms. Each marked trough in the indicator coincides with a price stabilization phase in earlier cycles. While the chart doesn’t imply immediate upside, it suggests that downside pressure may be diminishing as price approaches historically reactive levels.

This development matters for the broader crypto market since Ethereum often reflects overall market sentiment. A confirmed local bottom could help reduce near-term volatility and support broader market stability. However, the chart emphasizes patience, as similar setups in the past required time before meaningful price movement followed. The coming candles will be crucial in determining whether ETH completes this bottoming process or continues consolidating.

My Take: Ethereum’s technical setup looks promising, but crypto markets rarely reward impatience. The $2,900 zone has proven itself historically, and oversold readings are lining up nicely. Still, confirmation takes time—watch for volume and momentum shifts.

Source: 𝙲𝚁𝚈𝙿𝚃𝙾𝚇𝙻𝙰𝚁𝙶𝙴