NIO Slides Toward Key Support as Bears Press the Downtrend

NIO shares extended their decline on Thursday, slipping further into a major support region as the broader EV sector trades lower. Bearish pressure continues to dominate, with the stock drifting toward the lower boundary of its Fibonacci retracement zone. This move places NIO near a level that’s been closely watched after weeks of persistent downside momentum.

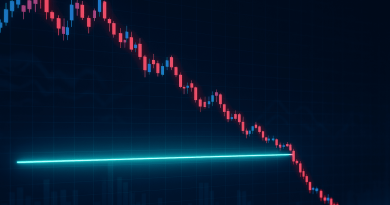

The chart shows NIO’s prolonged slide from early-November highs, following a clear pattern of lower highs and lower lows. Fibonacci levels between roughly $5.20 and $4.80 now form the primary support cluster. NIO is trading inside this zone, suggesting bearish momentum may be nearing exhaustion. Shares recently traded near $5.47, down nearly 5% on the day, while other EV names including TSLA, XPEV, and LI also finished in the red. The visible downtrend channel reinforces ongoing pressure, with no confirmed reversal signal yet.

The broader EV market has weakened in recent sessions, and NIO’s chart reflects this. The stock has retraced below the 0.618 Fib level, with the next potential support zones near the 1.0 and 1.272 extensions. Bears may be running out of room as price approaches these deeper levels, though NIO remains firmly within a declining structure.

This moment matters because NIO is approaching a historically reactive price zone that could determine the next several weeks of trading direction. A strong reaction at current support would signal whether the stock is preparing to stabilize or whether the downtrend will continue toward new lows. With the EV sector under pressure ahead of earnings, NIO’s positioning at these levels serves as a meaningful gauge of sentiment and risk appetite across the space.

source: NIO 🇨🇭 Investor