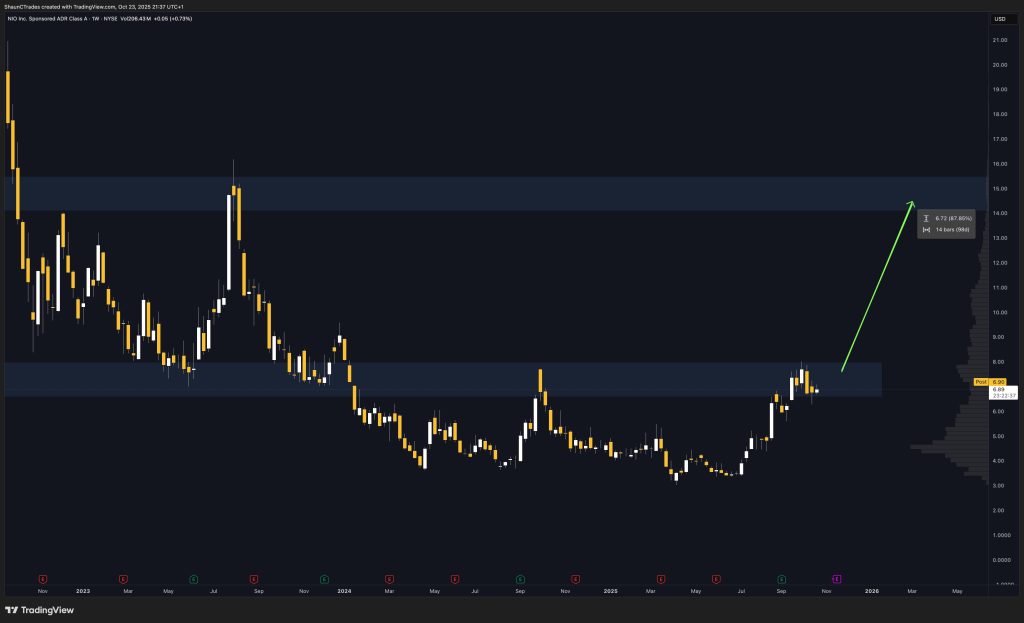

NIO Stock Outlook: Chart Suggests 27% Upside Potential

- Trader Shaun Trades recently posted “$NIO ~ Stay on target…”, pointing to a chart pattern that hints at building momentum for the Chinese EV maker. The weekly chart shows NIO consolidating just above $6.80 after months of sideways movement, creating a solid support level.

- The analysis suggests a possible 27–30% upside, with the next target zone between $13.50 and $15.00. The chart structure points to an accumulation phase, with the stock stabilizing in a liquidity zone between $6.50 and $8.00.

- This pattern might indicate institutional investors are quietly building positions ahead of a potential long-term recovery. However, risks are real—slowing EV demand in China, fierce competition from BYD and XPeng, and margin pressures could derail the thesis. A drop below $6.50 would break the bullish case.

- NIO has been working on cutting costs and improving production efficiency while expanding its premium EV lineup. Better free cash flow management and smarter capital spending could strengthen its foundation, especially if China’s EV incentives stay in place.

- NIO’s chart mirrors what’s happening across the EV sector. After getting hammered in 2024 by higher rates and valuation resets, there’s cautious optimism that easing monetary policy could bring investors back.