AMZN Stock Analysis: AI-Driven Growth

- Ray Myers recently pointed out that Amazon has evolved far beyond selling products online—it’s now a complete tech ecosystem where AI drives everything forward.

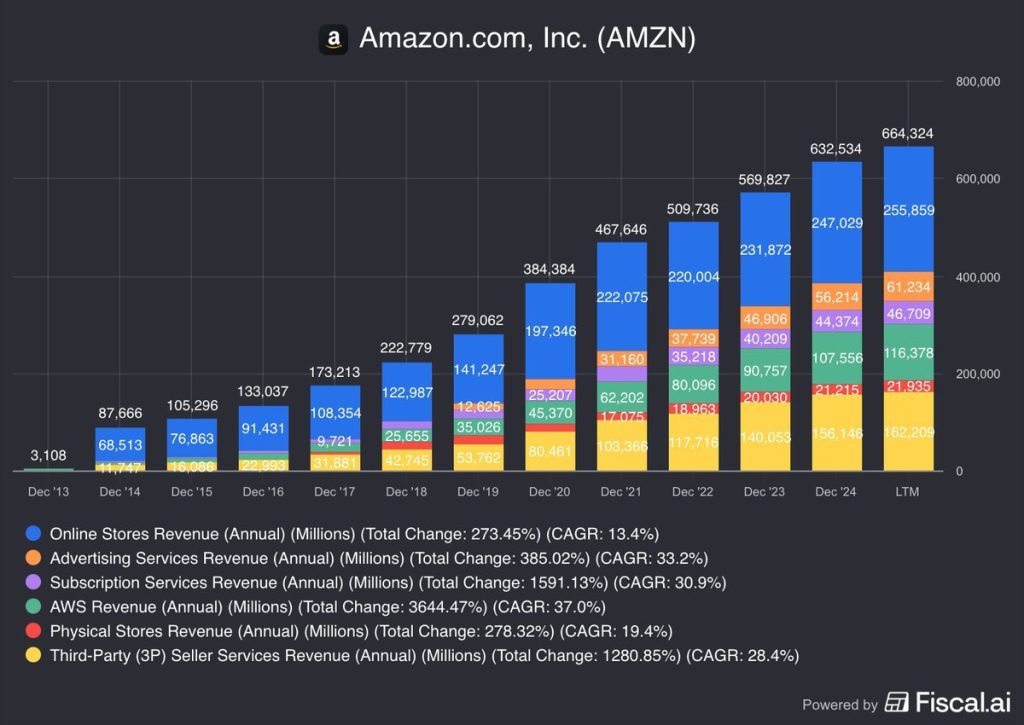

- Looking at the past ten years of data from Fiscal.ai, the transformation is striking, showing massive growth across cloud, logistics, and AI-driven services:

- AWS cloud services exploded by 3,644%, becoming the backbone of today’s AI boom. Subscription services and third-party seller revenue jumped 1,591% and 1,281%. Amazon’s ad business grew 385%, showing how effectively they monetize user data.

- The company’s interconnected ecosystem—Marketplace, Prime, Prime Video, and AWS—works like a well-oiled machine. The Marketplace uses AI to recommend products from an endless catalog. Prime delivers faster thanks to AI-optimized routing and inventory systems. Prime Video keeps users hooked within Amazon’s world. And AWS? It powers the cloud infrastructure for Amazon’s own AI and much of the industry’s.

- The playbook echoes MercadoLibre’s ($MELI) strategy: first, build a digital ecosystem combining shopping, logistics, entertainment, and cloud infrastructure. Then, weave AI into every layer to enhance user experience, cut costs, and boost margins.

- The financial impact could be huge. As AI automates logistics, marketing, and customer interactions, Amazon’s profit margins should expand significantly. It’s positioning itself not just as a retailer or cloud company, but as an AI infrastructure powerhouse.

Pingback: Amazon Stock News: AMZN Trading in $212-$240 Range - Finly.News