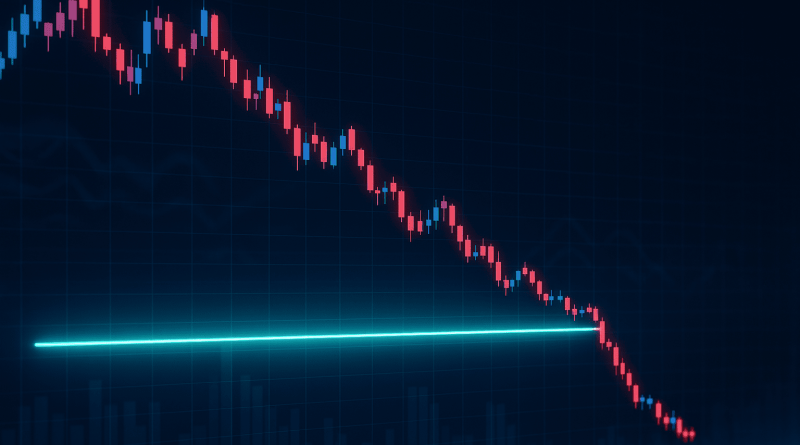

MSTR Drops to Critical Support as RSI Hits Levels Last Seen in COVID and 2022 Crashes

- MicroStrategy shares have hit a critical technical zone, entering oversold conditions seen only twice since the company went all-in on Bitcoin. The current RSI reading matches levels from the COVID crash and the 2022 bear market bottom. The stock is pulling back hard and testing a key horizontal support area.

- The pattern is clear: during both the COVID drop in 2020 and the 2022 capitulation, MSTR’s weekly RSI fell into the same oversold zone it’s visiting now. Both previous dips marked turning points where the stock stabilized as Bitcoin sentiment improved. Today, the RSI has dropped back into that red zone, matching the depth of earlier cycle lows. Price has declined sharply from recent highs toward the mid-$160 range, one of the steepest pullbacks in recent years.

The current RSI reading mirrors the levels seen during the COVID crash and the 2022 bear market bottom.

- The trend underscores MicroStrategy’s sensitivity to Bitcoin cycles given its massive BTC holdings. MSTR has acted as a leveraged Bitcoin play, often bouncing back strongly when market sentiment shifts. The current setup shows momentum exhaustion, and traders are watching whether this support holds or breaks for the first time since 2022.

- This matters because MSTR has become a barometer for crypto-equity sentiment. How the stock reacts at this historically oversold level could shape expectations for broader crypto-linked assets and signal market positioning for the next phase of the Bitcoin cycle.

My Take: This support test is worth watching closely. If MSTR holds here like it did in 2020 and 2022, we could see another strong recovery phase. The Bitcoin cycle connection remains strong, and these oversold extremes have been reliable buy zones historically.

Source: Crypto Rover