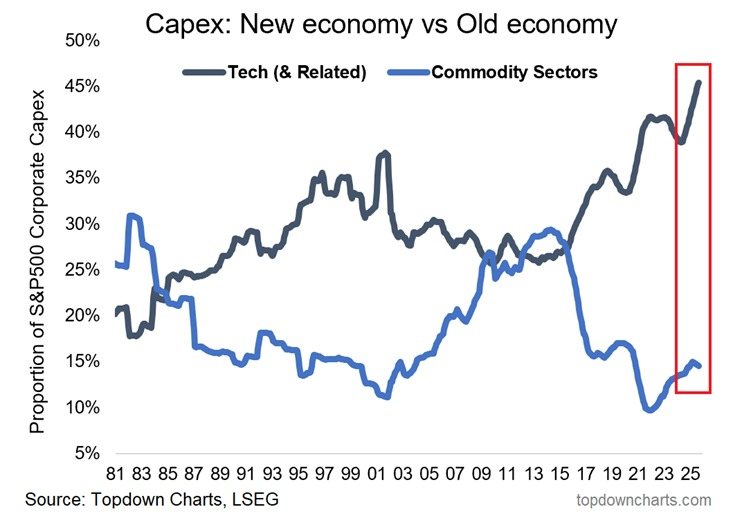

Tech CapEx Hits Record 45% of S&P 500 as NVDA and AI Drive Historic Spending Shift

- Capital spending patterns across the S&P 500 just hit a milestone that hasn’t been seen in decades. Technology and related sectors now control 45 percent of all corporate CapEx—a jump of roughly 20 percentage points over the last ten years. The data shows tech investment has blown past the previous record from the Dot Com bubble, when the peak topped out around 39 percent. The chart tells the story: a sharp, unrelenting climb in spending tied to digital infrastructure and computing power.

- Meanwhile, commodity-sector CapEx has been bleeding out. These industries now account for just 15 percent of S&P 500 capital expenditures, down by half since 2015. That’s only five percentage points above the lowest mark recorded in 45 years. The contrast couldn’t be starker—tech spending racing to all-time highs while commodity investment sits near rock bottom. Capital is pouring into scalable, data-hungry technologies built around artificial intelligence.

- This surge lines up perfectly with the AI explosion reshaping corporate strategy. Nvidia and the big cloud players keep expanding compute capacity, while hyperscalers pump billions into data centers, GPUs, and infrastructure designed for training and inference workloads.

The composition of corporate investment reflects confidence that AI, cloud, and digital platforms will drive the next phase of economic growth.

- With tech CapEx at record levels, companies are betting hard that AI scaling and digital infrastructure will define the next era of growth. The collapse in commodity-sector spending highlights just how much traditional resource industries have faded from S&P 500 investment priorities. This realignment isn’t temporary—it signals a fundamental pivot in how the US economy generates value, with technology-focused growth now driving the entire investment landscape.

My Take: The 45% tech CapEx share isn’t just a data point—it’s proof that corporate America has made its choice. AI infrastructure is eating everything, and traditional sectors are getting left behind. This concentration creates massive opportunity but also serious risk if the AI buildout doesn’t deliver expected returns.

Source: The Kobeissi Letter