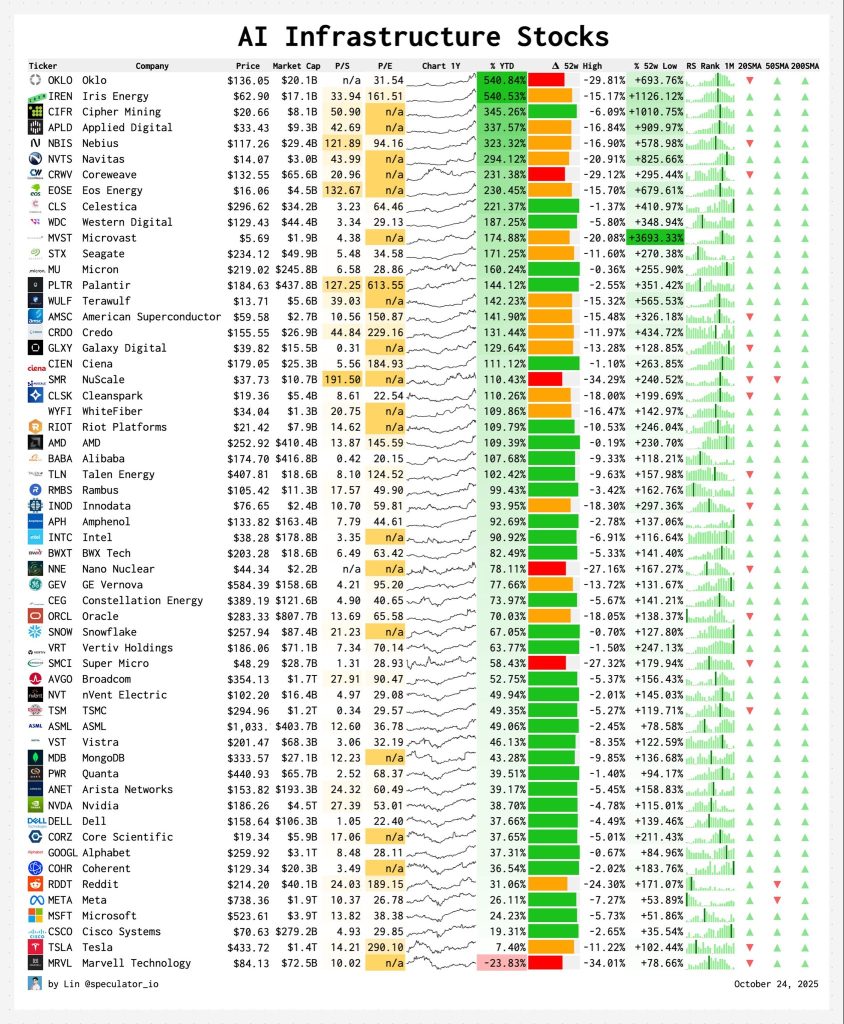

AI Infrastructure Stocks Skyrocket as Oklo and Iris Lead Gains

- A recent ranking from The AI Investor shows dramatic performance splits across AI infrastructure stocks this year. While Oklo is up 540%, Iris Energy 446%, and Cipher Mining 345%, established players like Nvidia (+41.9%) and Broadcom (+66%) are moving more conservatively. Money is pouring into smaller names tied to energy, data centers, and chip supply chains as investors scramble for AI hardware exposure.

- Many small and mid-cap AI stocks are trading at stretched valuations disconnected from actual earnings. While AI demand for computing power is real, analysts worry that excessive speculation could lead to sharp corrections when growth inevitably slows.

- Companies like Oklo (nuclear microreactors) and Iris Energy (pivoting from Bitcoin mining to AI hosting) have grabbed institutional interest. Meanwhile, AMD (+118%) and Nvidia offer lower-risk exposure with solid fundamentals. Diversified plays like Oracle, Snowflake, and Vertiv are attracting investors seeking more balanced infrastructure-plus-software growth.

- Over 20 stocks on the list are up more than 100% year-to-date, spanning semiconductors to clean energy. This points to a real capital reallocation around AI infrastructure—but volatility is high. As @The_AI_Investor put it: “Price action in some stocks seems to be getting out of control while $NVDA remains reasonable.” Whether this becomes a long-term industrial cycle or faces a near-term reset depends on how quickly hype converts to actual profits.