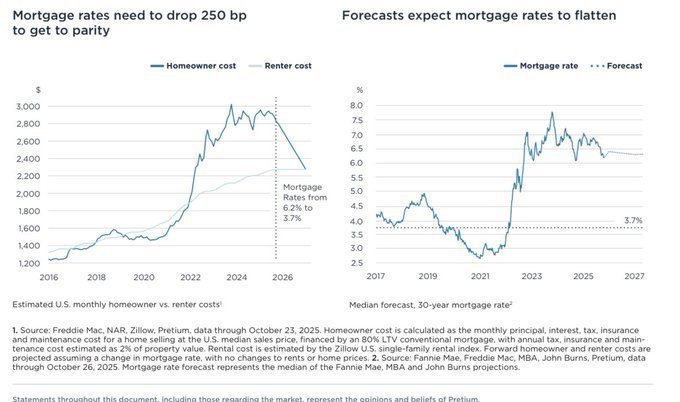

US Mortgage Rates Need 250 bps Drop to Restore Renting–Owning Parity

- The housing market keeps getting tougher for potential buyers. Pretium’s recent analysis shows that owning a home costs way more than renting right now. To balance things out, mortgage rates would have to fall by about 2.5 percentage points—from today’s 6.2% down to around 3.7%. That’s a massive drop that doesn’t look likely anytime soon.

- The numbers tell a clear story. Homeowner costs shot up dramatically between 2020 and 2024, hitting close to $3,000 per month in 2024. Meanwhile, rental costs increased at a much slower pace and stayed significantly lower. While homeownership expenses have cooled off slightly in recent months, the gap between buying and renting remains huge.

Restoring cost parity would require mortgage rates to decline by about 2.5 percentage points, from current levels near 6.2 percent to roughly 3.7 percent.

- Mortgage rates have been all over the place lately. They spiked hard over the past three years before leveling off recently. The current forecast suggests rates will stay relatively flat rather than dropping sharply. This means the cost difference between renting and owning isn’t going away quickly.

- High financing costs are reshaping how Americans think about housing. Since mortgage rates probably won’t return to 3.7% levels anytime soon, renting will keep being the smarter financial choice for many families. This affordability crisis is also affecting people’s ability to move for jobs or life changes, potentially impacting the broader economy.

My Take: The 250 bps gap highlights how dramatically the Fed’s rate hikes transformed housing. Unless we see a major economic downturn forcing aggressive rate cuts, this renting advantage could persist for years, fundamentally changing American homeownership patterns.

Source: Lisa Abramowicz