EUR/USD Under Pressure Near Key Support Zone

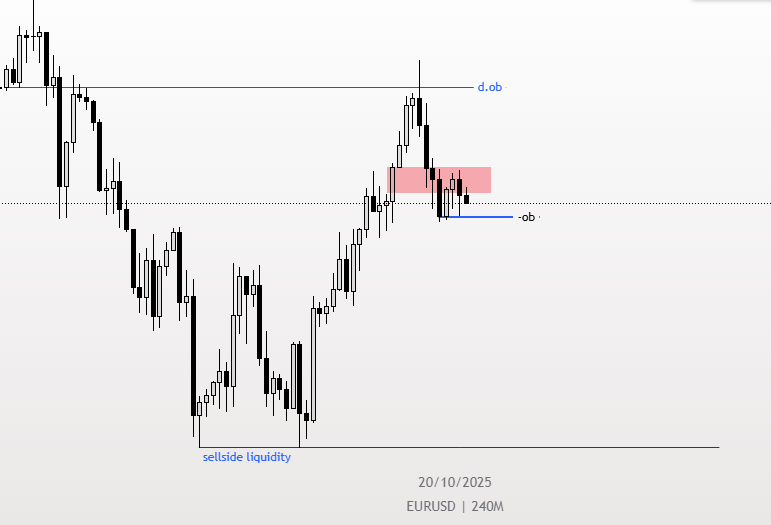

- Trader KIPKOECH BRIAN recently highlighted an important technical setup for EUR/USD, noting that “a body close below the blue line could lead to lower prices.”

- The 4-hour chart backs up this cautious view. The pair has stalled below a daily order block (marked in red) and is now hovering just above a smaller order block shown in blue. Price action suggests the market is at a decision point—either resume the decline or stage a bounce.

- After failing to hold ground near the upper resistance zone, EUR/USD has been drifting sideways, a pattern that often precedes a continuation move. If a full candle body closes below the blue support area, it would likely confirm bearish momentum and open the door to the sell-side liquidity target near prior swing lows.

- The setup fits with the broader market backdrop—dollar strength driven by rising Treasury yields and cautious investor positioning. The euro’s struggle to reclaim higher levels underscores short-term seller dominance.

Pingback: EUR/USD Extends Drop as Overnight Algorithmic Move Catches Traders Off Guard - Finly.News