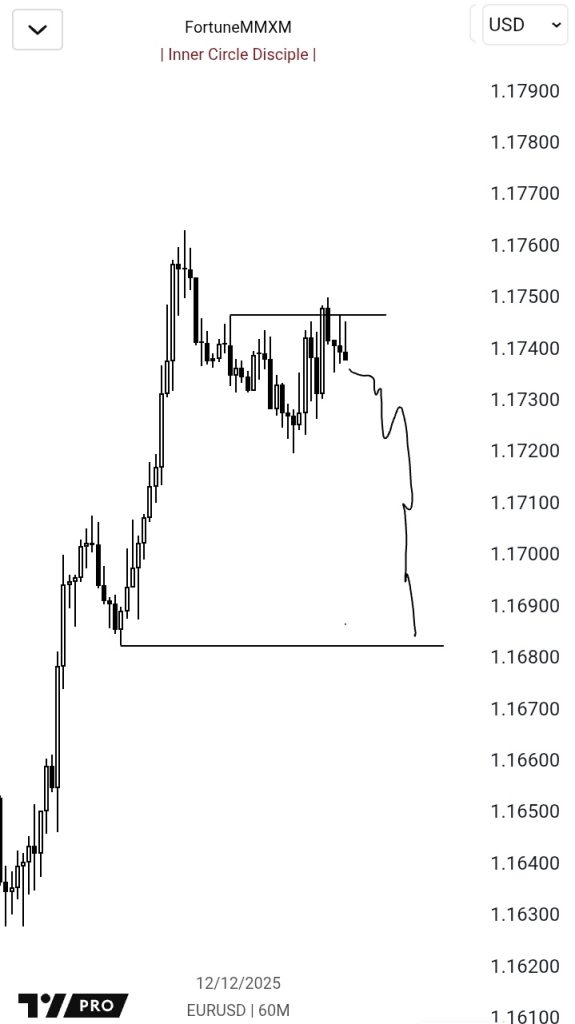

EUR/USD Price Outlook Shows Need for Market Confirmation at 1.1750 Resistance

- EUR/USD is being closely monitored, but confirmation is still required before drawing firm conclusions about direction. The accompanying 60-minute chart illustrates a sharp upward move followed by consolidation beneath a clearly defined resistance area near 1.1750, signaling hesitation after the prior rally.

- Price action shows that EUR/USD formed higher highs during the initial advance, then transitioned into a sideways range as buying momentum slowed. Multiple candles have failed to close decisively above the same resistance zone, while support appears to be developing closer to the 1.1680 area. This structure reflects a temporary balance between buyers and sellers, often seen before a directional resolution.

Confirmation is needed before expecting continuation of the prior bullish move, as premature positioning during range-bound conditions can lead to false signals.

- The projected path drawn on the chart suggests a potential downside scenario if price fails to confirm a breakout above resistance. The illustrated move implies that rejection from the upper boundary could lead to a pullback toward lower support levels. This aligns with the cautionary tone, emphasizing that confirmation is needed before expecting continuation of the prior bullish move.

- EUR/USD remains sensitive to short-term momentum shifts, particularly on intraday timeframes where consolidation frequently precedes volatility expansion. The current setup highlights the importance of waiting for confirmation, as premature positioning during range-bound conditions can lead to false signals. Until price either reclaims resistance or breaks decisively lower, EUR/USD is likely to remain in a holding pattern as traders assess the next move.

My Take: The 1.1750 resistance level will be the key battleground for EUR/USD in the near term. A confirmed breakout could trigger renewed bullish momentum, while rejection may lead to a deeper correction toward 1.1680 support. Patience is essential here.

Source: Fortune MMXM