EUR/USD Analysis: 4H–15M Charts Point to Downside

- Trader KIPKOECH BRIAN recently shared a technical outlook on EUR/USD, noting strong alignment between the 4-hour and 15-minute charts—both pointing to further downside. When multiple timeframes agree like this, it often strengthens the case for continuation.

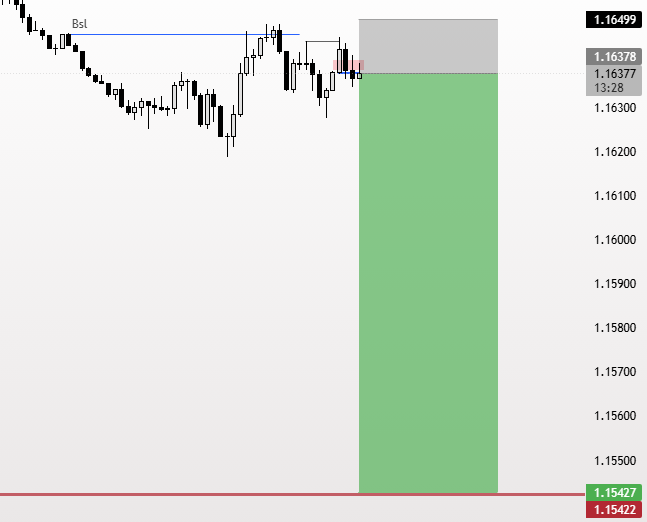

- EUR/USD stalled near 1.1650 after testing what traders call “buy-side liquidity”—essentially a zone where buyers had been active. The pair is now hovering around 1.1637, consolidating after that rejection. Sellers are holding the line at the upper boundary, which suggests they’re in control for now.

- If price suddenly breaks higher, it could trap shorts and invalidate the bearish setup before reversing again. That’s always the danger with these setups near key levels.

- The euro has been choppy lately due to uneven data out of the Eurozone and shifting expectations around Fed rate policy. If EUR/USD slips below 1.1620 and holds, the technical path opens toward 1.1540–1.1550, which is the target zone highlighted in the analysis.

- The proposed entry includes a tight stop around 1.1649 and a target near 1.1542—a decent risk-to-reward for those trading the breakdown. The green zone marks the profit area, while the gray box above shows where the trade idea fails.