XRP Price Drop Pushes 42% of Supply Into Loss, Glassnode Data Shows

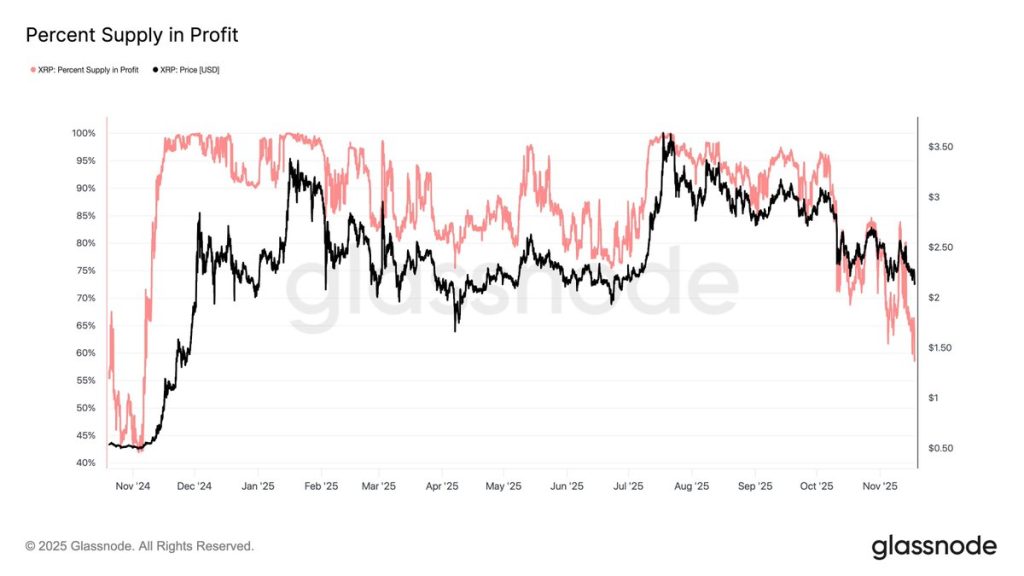

New Glassnode data reveals XRP is going through one of its toughest stretches in over a year. The share of supply sitting in profit has nosedived in November, with roughly 41.5% of all XRP now held at a loss. That’s the same profitability level we last saw back in November 2024, when the token was trading around $0.53. The drop comes after weeks of steady price weakness.

The Glassnode chart tells the story pretty clearly. XRP’s price has been falling throughout the month, while the percentage of supply in profit has been trending down to multi-month lows. For most of the past year, XRP kept profitability above 70%, helped along by several solid rallies. But this latest slide marks a real shift, with the price breaking below recent support and putting a big chunk of holders into the red.

What’s happening with XRP reflects the broader volatility hitting the market. After failing to get back above the late-summer highs around $3.00, the token went into a long pullback that’s knocked out a lot of profitable positions. Earlier in 2025, there were a few attempts at recovery, but this recent downturn has been particularly harsh, dragging profitability from the mid-60% range down to 41.5%.

The shrinking pool of profitable supply matters because it shows how sentiment around XRP is shifting, and it could point to weaker momentum across the wider crypto market. With XRP still under pressure, tracking these profitability metrics will be key since they often signal market stability, risk appetite, and potential turning points during extended downtrends.

source: Walter Bloomberg