TSLA Targets 502–540 After Completed Correction

- Tesla stock is showing signs of a bullish reversal after completing a corrective phase, with analysts projecting a potential rally toward the 502–540 range.

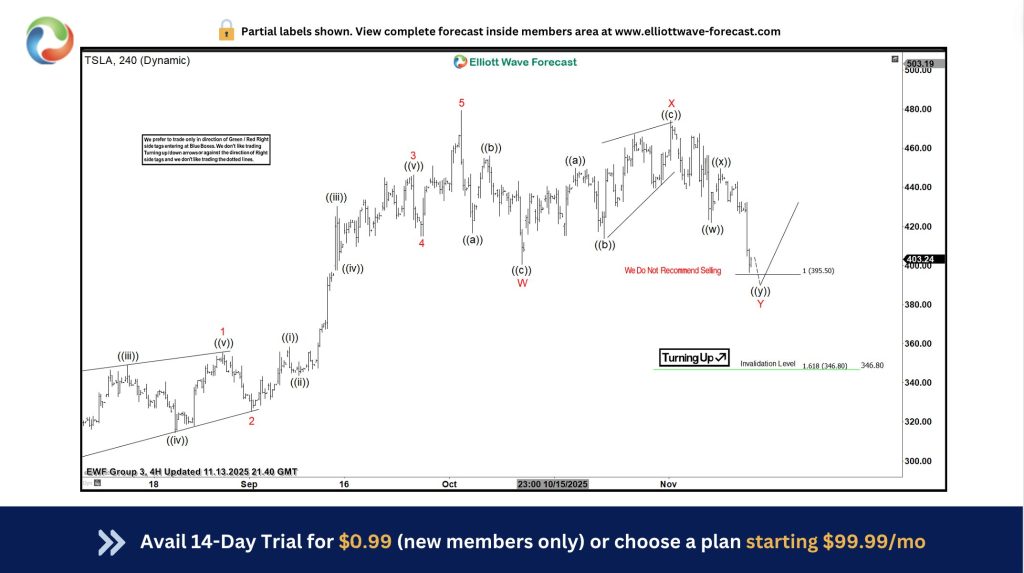

- In a recent statement, Elliott Wave Forecast highlighted that Tesla may be entering a new upward phase after completing a multi-month correction. According to the analysis, the decline reached its extreme area in line with the forecast from November 13, and TSLA has since confirmed a rebound from the 381.01 low. The charts show the correction unfolding within an Elliott Wave structure, with the price remaining comfortably above the key invalidation level at 346.8.

- The completed corrective pattern suggests renewed bullish momentum. The updated Elliott Wave count outlines a potential recovery path that keeps Tesla within a constructive structure despite recent volatility. The model indicates that the wave sequence has turned up after bottoming at the measured support zone, confirming what analysts describe as the “4-hour extreme area” reaction.

The decline reached its extreme area in line with the forecast from November 13, and TSLA has since confirmed a rebound from the 381.01 low.

- With Tesla holding above 381 and maintaining higher-timeframe support, the focus now shifts to upside targets. The analysis points to a projected move toward the 502.5–540 price region, which corresponds to the next major resistance cluster highlighted on both charts. This aligns with historical rally extensions and the expected completion of the next Elliott Wave cycle. The charts show improving short-term structure and continued strength despite broader market fluctuations, reinforcing the bullish outlook indicated in the wave model.

- This outlook matters for the broader market because Tesla remains one of the most influential momentum stocks within the technology and EV sectors. A confirmed rally into the 500+ range could strengthen overall sentiment in high-growth equities, support risk-on appetite, and reassert TSLA’s leadership in market dynamics. The forecast also provides clearer technical thresholds — particularly the 346.8 invalidation level — that traders may watch closely as the next major move develops.

My Take: Tesla’s technical setup looks promising here. The 381 support held firm and the Elliott Wave structure suggests we’re in the early stages of the next leg up. If TSLA breaks through 450 with volume, the 502-540 zone becomes highly probable. Key risk remains below 346.8.

Source: Elliottwave Forecast