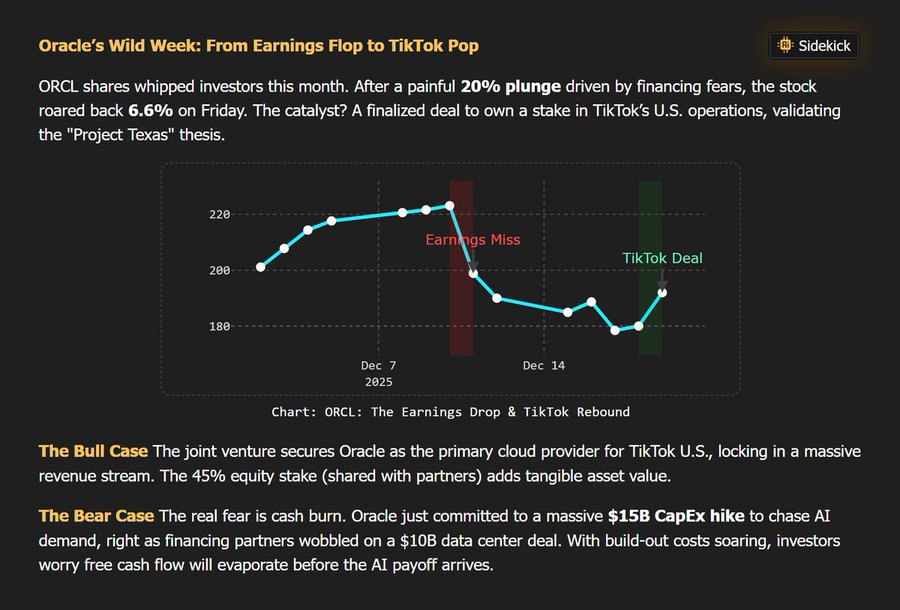

ORCL Stock Rebounds 6.6% as TikTok Deal Eases CapEx Fears

Oracle (ORCL) had a wild ride in December. The stock tanked nearly 20 percent after disappointing earnings sparked fresh concerns about financing and cash flow. But sentiment flipped when Oracle confirmed its deal with TikTok’s U.S. operations, sparking a 6.6 percent rally in just one session.

The sharp recovery came after Oracle secured its role as TikTok U.S.’s main cloud infrastructure provider. It’s a massive win—landing a huge enterprise customer with serious long-term data and computing needs. Oracle’s also grabbing around 45 percent equity in the venture alongside partners, which adds real asset value on top of steady cloud revenue. After weeks of selling pressure, this deal gave investors something concrete to feel good about again.

“Strategic developments such as the TikTok U.S. deal can rapidly shift sentiment by reinforcing long-term growth ambitions.”

Still, there’s plenty of caution lingering. Oracle just signaled it’s ramping up capital spending to about $15 billion for data centers and AI infrastructure. That came after confusion around a $10 billion data center project, making investors nervous that free cash flow could take a hit before AI and cloud investments actually pay off. This CapEx anxiety was behind the initial selloff.

What we’re seeing is Oracle walking a tightrope. Big moves like the TikTok deal can quickly restore confidence in the growth story, but aggressive spending keeps testing whether management can balance expansion with financial discipline. How Oracle manages this trade-off could shape how investors view other large-cap cloud and enterprise software players riding the AI wave.

My Take: Oracle’s rebound shows how quickly narrative can shift in cloud infrastructure stocks. The TikTok deal is real validation, but $15B in CapEx is no joke. Investors want growth, but they also want to see returns before cash flow gets squeezed too thin.

Source: TrendSpider