NIO Stock Eyes $10 After Completing Bullish Pattern

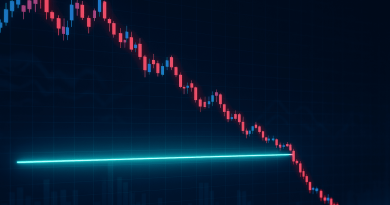

Electric vehicle maker NIO has been stuck in a sideways pattern for weeks, but the latest chart formation suggests something bigger might be brewing. Trading near $7.00, the stock is showing signs of completing a “running flat” correction—a rare bullish setup that often comes before sharp rallies. If this pattern plays out, NIO could be heading toward $10.

Trader Muhannad Zetouny pointed out the setup, saying “$NIO seems to be finishing its running flat now. If this is correct, the stock is likely running to $10 in the next few weeks. Running flats are rare, and very bullish.”

What the Chart Shows

The 30-minute chart reveals overlapping corrective waves labeled (A)–(B)–(C), followed by a five-wave decline through (1)–(5). This structure is typical of a running flat, where prices consolidate without making lower lows—a sign of underlying strength.

Key Technical Points:

- Support: The $6.85–$7.00 zone has been holding firm, catching every dip

- Resistance: Watch $7.40 and $7.80, with $8.00 as the major breakout level

- Moving Average: NIO is testing its 30-period MA, which has blocked previous rallies—a break above this line would signal shifting momentum

- Volume: Sell-offs have been light while rallies show buying spikes, suggesting accumulation

The Elliott Wave count supports the idea of a completed correction and potential reversal.

What Could Drive the Move

Chart patterns aside, there are real-world factors that could fuel this rally. China’s EV industry keeps getting government support, and NIO is positioned to benefit despite tough competition. The company’s global battery-swapping initiatives and potential international deals add to the speculative interest. Plus, U.S.-listed Chinese stocks are getting fresh attention from traders looking for undervalued comeback stories, and NIO fits that profile.

Can It Actually Hit $10?

If the running flat confirms, NIO could jump more than 40% from here. The first test is clearing $7.40–$8.00 with conviction and volume. From there, $10 becomes realistic. But there’s a flip side—if the stock drops below $6.85, the bullish setup falls apart and could trigger more selling.

Pingback: NIO Stock Outlook: Chart Suggests 27% Upside Potential - Finly.News