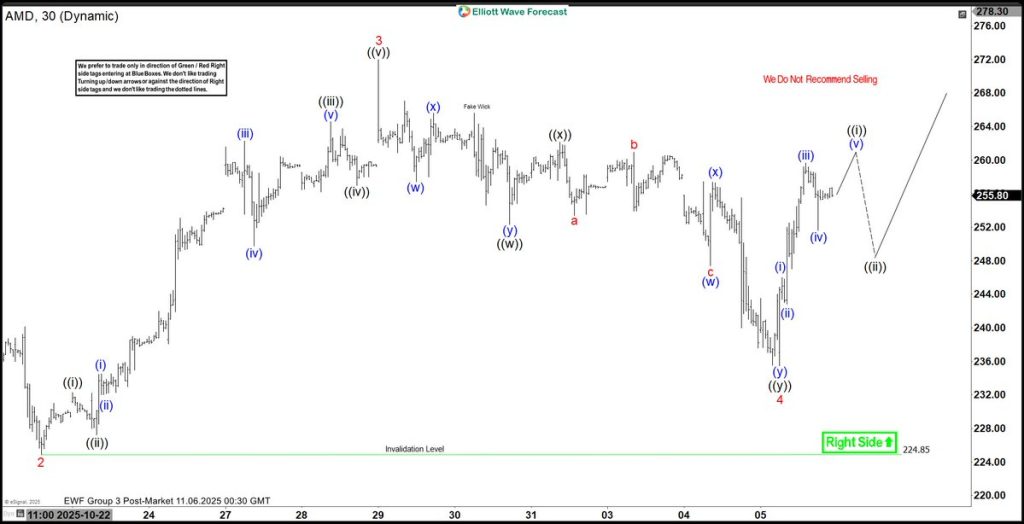

AMD Stock Forecast: Bullish Momentum Continues

- AMD continues its bullish trajectory after hitting fresh all-time highs last month. Technical analysis suggests the current upward wave isn’t finished yet. As long as the critical $224.85 support level stays intact, the stock could climb toward the $280.50–$294.40 range. The chart shows a clear bullish Elliott Wave pattern with a “Right Side” bias favoring upward movement—selling is not recommended at this stage.

- This bullish outlook presents both opportunities and risks. A sustained rally could put pressure on smaller chip makers, potentially causing financial difficulties as capital flows to industry leaders like AMD. The company’s growing dominance might also attract top engineering talent away from competitors, reshaping the semiconductor workforce.

- If AMD respects the $224.85 floor, investors could see significant gains as the pattern completes. A more cautious approach involves taking partial profits along the way while keeping exposure to AMD’s long-term growth potential.

- AMD’s strength has broader implications for the semiconductor sector—driving investment, creating jobs, and generating tax revenue. As the company solidifies its market position, capital and talent are likely to concentrate around it, expanding its economic influence.

- Bottom line: AMD’s technical setup remains bullish. With the $224.85 level holding, Elliott Wave analysis suggests more upside ahead. Strong momentum and institutional backing keep the stock well-positioned for continued gains.

Source: Elliottwave Forecast