UK Faces Record Millionaire Exodus

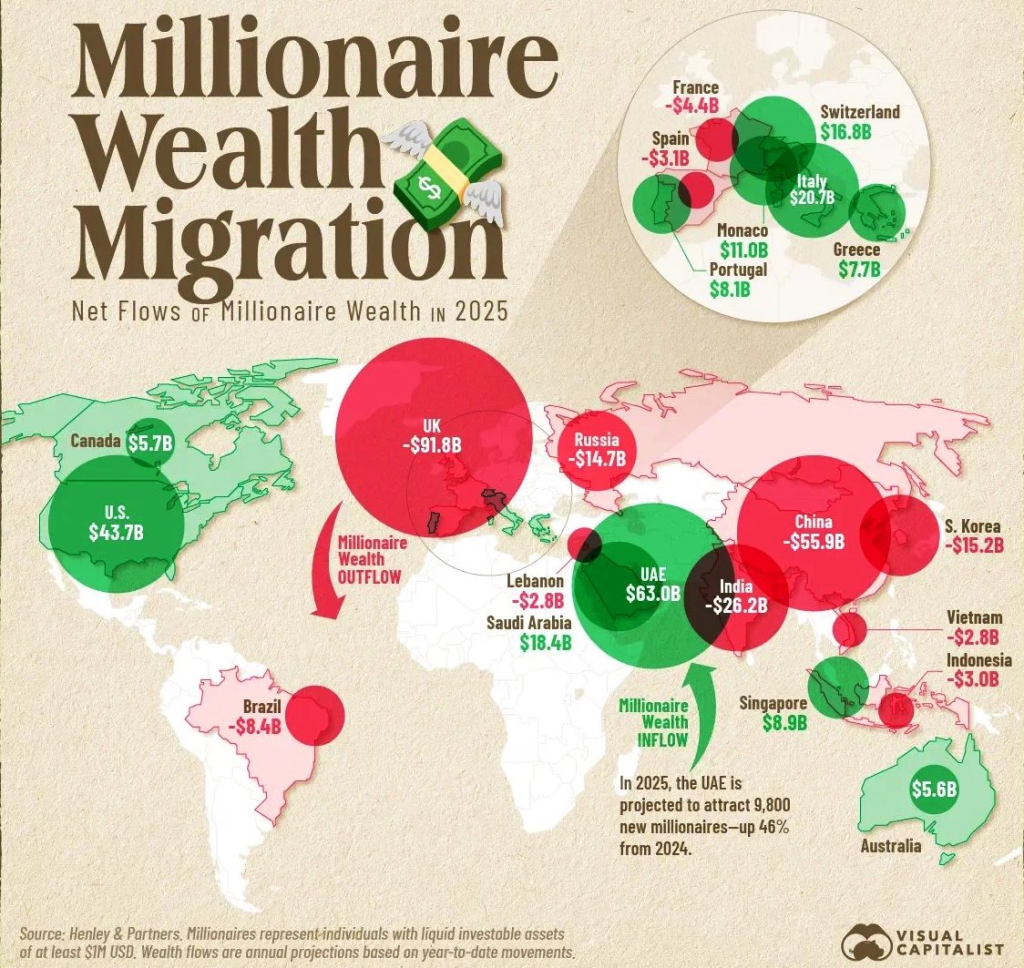

- The United Kingdom is hemorrhaging wealth at an alarming rate. According to fresh data from Henley & Partners and Visual Capitalist, the country is set to lose a staggering $91.8 billion in millionaire wealth this year—the biggest net outflow globally.

- Twitter user Michael A. Arouet called the situation “unprecedented,” pointing to a familiar pattern: left-leaning governments keep raising taxes expecting revenues to climb, but wealthy residents simply leave instead.

- The numbers tell a stark story. While the UK bleeds $91.8B, other major economies are also watching their wealthy citizens pack up: China is losing $55.9B, India $26.2B, South Korea $15.2B, Russia $14.7B, and Brazil $8.4B. European neighbors aren’t immune either—France expects to lose $4.4B and Spain $3.1B.

- Where’s all this money going? Straight to countries rolling out the red carpet with lower taxes and business-friendly policies. The UAE is the big winner, attracting $63.0B, followed by the United States ($43.7B), Switzerland ($16.8B), and Italy ($20.7B). Singapore, Portugal, Greece, Australia, and Canada are also cashing in on this global reshuffle.

- This exodus comes as the UK debates ramping up income taxes, introducing wealth taxes, and expanding financial reporting requirements. Proponents say these moves will shore up government finances. Critics argue they’re shooting themselves in the foot—higher taxes drive away the wealthy, which shrinks the tax base and defeats the whole purpose.

- As Michael A. Arouet points out, it’s not just money leaving—it’s “countless jobs they take with them.” High-net-worth individuals bring investment capital, launch businesses, and create employment. When they relocate, local economies suffer and opportunities dry up.

- The 2025 wealth migration data confirms what’s becoming impossible to ignore: countries with competitive tax systems and stable regulations are winning, while high-tax jurisdictions are losing ground. For the UK, stopping a $91.8B wealth drain will take more than political spin—it’ll require serious, pro-growth reforms that actually make the country attractive again.