G7 Faces Sharp Decline in Influence

- Tech entrepreneur Balaji recently painted a vivid picture of where the G7 is headed, calling it a car “going downhill” that keeps swerving but never stops falling. New IMF data, charted by The Economist, backs up that image pretty starkly.

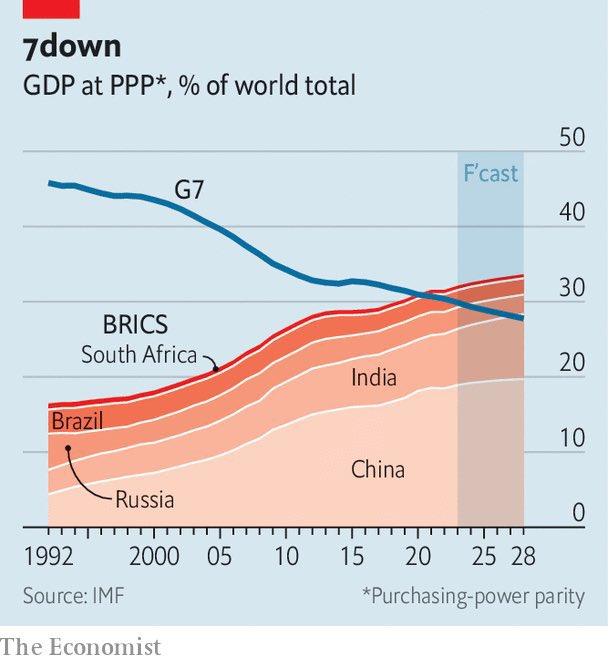

- The numbers tell a clear story: the G7’s share of world GDP has been sliding for decades. What used to be north of 45% in the early 90s is now below 30%, and projections show the decline continuing through 2028.

- On the flip side, BRICS countries—especially China and India—have been climbing steadily. Their combined economic weight has already passed the G7’s, powered by massive populations, industrial scale-up, and structural growth. Russia, Brazil, and South Africa add to the mix, creating a bloc that now influences everything from energy markets to global supply chains.

- This economic realignment is creating real headaches for G7 policymakers. Some governments are floating higher corporate or wealth taxes to shore up budgets hit by slower growth. But critics warn these moves could backfire—driving businesses under, scaring off investment, and pushing talent overseas, especially in tech sectors already getting squeezed.

- The stakes go beyond tax collection. As the G7’s economic share shrinks, so does its ability to shape global decisions and fund priorities. Less tax revenue from slower sectors means tighter budgets down the line. Some business voices are pushing a different approach: tax big multinationals more while easing the load on smaller innovators.

- Balaji’s downhill metaphor fits the data well. The G7 line keeps dropping despite occasional bumps upward—like a car weaving as it falls. BRICS, meanwhile, climbs steadily, redrawing the map of economic power.

- With momentum shifting toward emerging economies, G7 nations are under pressure to overhaul tax systems, sharpen competitiveness, and face a reality where economic leadership isn’t automatically theirs anymore.