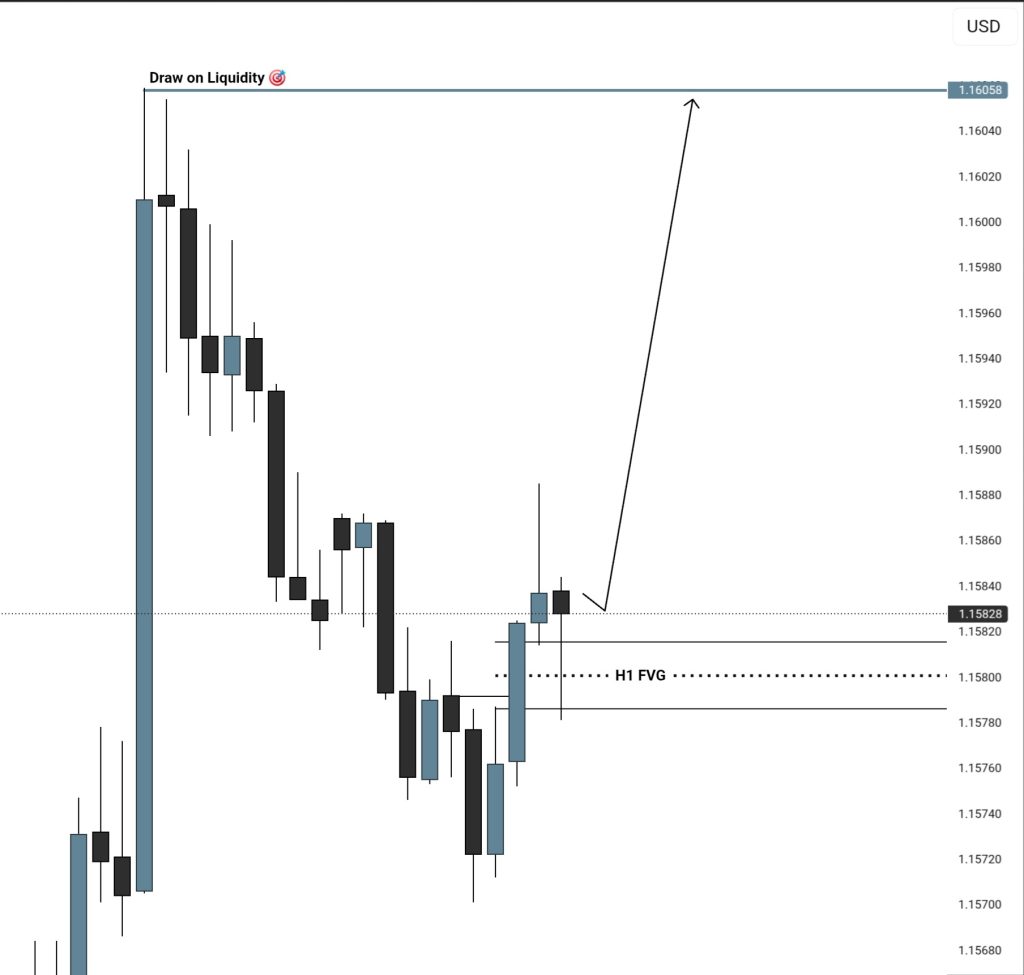

EUR/USD Forecast: Bulls Target 1.1605 Liquidity Zone

- A recent technical analysis reveals a bullish EUR/USD outlook on the H1 timeframe, highlighting strong potential for price to move toward 1.1605. After a corrective dip, the pair found solid support around the H1 Fair Value Gap near 1.1580, where buyers stepped back in and reinforced the short-term uptrend.

- The setup shows EUR/USD holding steady above the reclaimed FVG, with a clear path projected toward 1.1605—a key liquidity zone where stop orders and resting buy interest are likely clustered. This suggests continuation of bullish momentum once minor pullbacks are absorbed.

- The 1.1580–1.1582 zone acts as immediate support, aligning with the H1 FVG midpoint. This area is critical for maintaining the bullish scenario. A break below could temporarily push price back toward 1.1570–1.1565, where previous lows rest. However, the overall structure remains positive, backed by strong rejection candles from lower levels and a pattern of higher highs on smaller timeframes.

- From a broader perspective, the euro’s strength aligns with softer U.S. dollar sentiment and cautious positioning ahead of upcoming U.S. data releases, adding fuel to the potential rally.

- The analysis points to a clear bullish continuation setup, with the next target at 1.1605 where liquidity is expected to be drawn. As long as the pair holds above 1.1580, the bias remains firmly bullish—indicating buyers are in control of short-term momentum.

Source: Sir Hisham