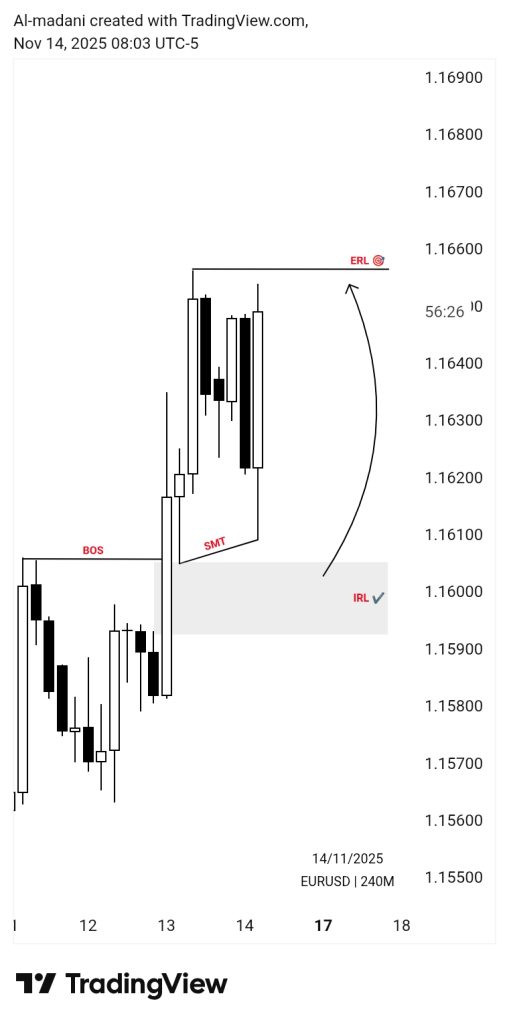

EUR/USD Price Prediction: Sharp Move Leaves Traders Behind

- EUR/USD delivered a fast, decisive move across key market levels on the 4H chart, leaving many traders without an entry opportunity. The price action revealed a rapid shift: EURUSD tapped the IRL zone near 1.1600, formed a Break of Structure (BOS), then created an SMT deviation before accelerating upward toward the ERL area around 1.1660. This sudden rally unfolded without a meaningful pullback, sidelining many traders during one of the cleanest structural reactions of the week. The move coincides with growing policy discussions around new tax proposals that could reshape financial market dynamics.

- A series of tax changes aimed at increasing the fiscal burden on financial and digital firms has sparked concern. Industry participants warn these changes could trigger immediate bankruptcies, operational strain, and talent flight as professionals migrate toward jurisdictions with more stable regulatory frameworks. In such an environment, pairs like EUR/USD often experience heightened volatility as markets react to rapid shifts in sentiment and macroeconomic expectations.

- The proposed amendments could reduce government revenue by shrinking corporate profitability, lowering trading volumes, and weakening liquidity across financial markets. Industry leaders propose an alternative solution—adjusting the profit tax rate instead of implementing more disruptive labor-based taxes. They argue this method would secure necessary budget revenue while preserving the operational capacity of financial institutions.

- Additional amendments involving reporting standards, depreciation rules, and digital asset classification could significantly reduce personal income tax and profit-tax contributions as companies downsize, scale back hiring, or relocate operations abroad. In parallel, EUR/USD’s sharp move from IRL to ERL reflects how sensitive the currency pair has become to structural and policy-related uncertainty.

- The challenge traders faced during this rapid shift is notable. With no clear entry point available and price moving directly between major reaction levels, the market’s reaction reveals the growing influence of regulatory developments on short-term currency behavior. As policymakers debate revisions to the tax proposal, EUR/USD’s outlook will continue to depend on the interplay between technical structure and evolving fiscal conditions.

Source: MR | EUR