Shiba Inu ($SHIB): Bullish Divergence Signals Potential Breakout Ahead

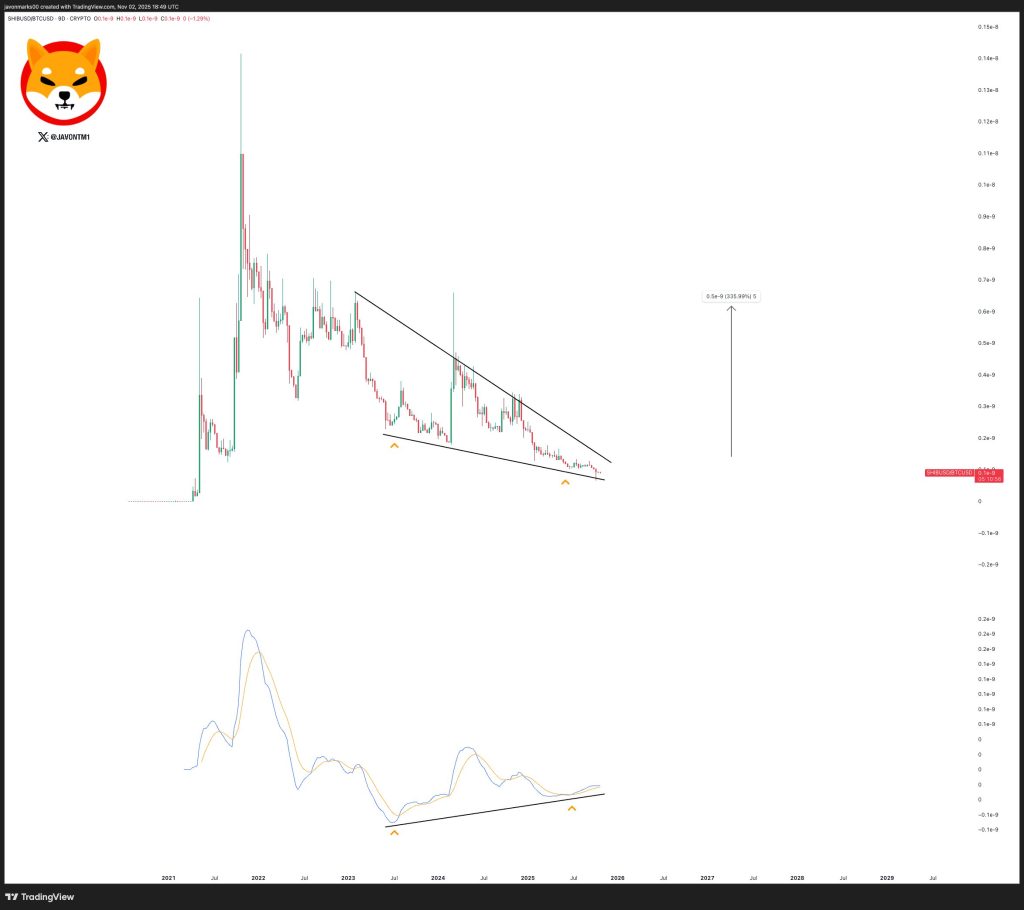

Shiba Inu may be a meme coin, but its chart is starting to look serious. Combined with a symmetrical triangle formation that’s been building for weeks, the technical setup suggests the dog-themed token could be gearing up for a big move. If the breakout happens, we might be looking at gains measured in the hundreds of percentage points.

What the Chart Is Telling Us

According to Javon MARKS, SHIB is showing a textbook bullish divergence—a signal that often precedes a trend reversal.

The technical picture for Shiba Inu revolves around three key elements:

- Symmetrical triangle pattern — SHIB has been consolidating inside this formation, creating lower highs and higher lows. It’s a classic sign of indecision before volatility expands, and in this case, the bias leans bullish.

- Bullish RSI divergence — While SHIB’s price has been making lower lows, the RSI has been making higher lows. That disconnect suggests weakening downward momentum and hints at a potential reversal.

- Key support holding strong — The lower trendline of the triangle has been tested multiple times, and buyers keep stepping in. If SHIB breaks above the upper resistance line, it could trigger a sharp rally.

What Could Drive the Move?

A few factors are lining up in SHIB’s favor. The Shiba Inu community remains active and engaged, with ongoing developments like ShibaSwap and the Shiba metaverse keeping interest alive. Plus, like most altcoins, SHIB tends to follow Bitcoin’s lead—so if BTC catches a bid, capital could flow into meme coins looking for leverage. Broader crypto market sentiment also matters, especially as investors hunt for alternatives in uncertain economic times.

Shiba Inu’s chart is flashing bullish signals, and if the breakout materializes, the upside could be significant. But as always with crypto—especially meme coins—volatility cuts both ways. Keep an eye on that upper trendline. If SHIB punches through, things could get interesting fast.