Ethereum Q4 Outlook: Historical Patterns Show a Critical Seasonal Test

Ethereum’s fourth-quarter performance has historically been a defining moment for its yearly trajectory—and 2025 might be the most telling year yet.

A Tale of Three Fourth Quarters

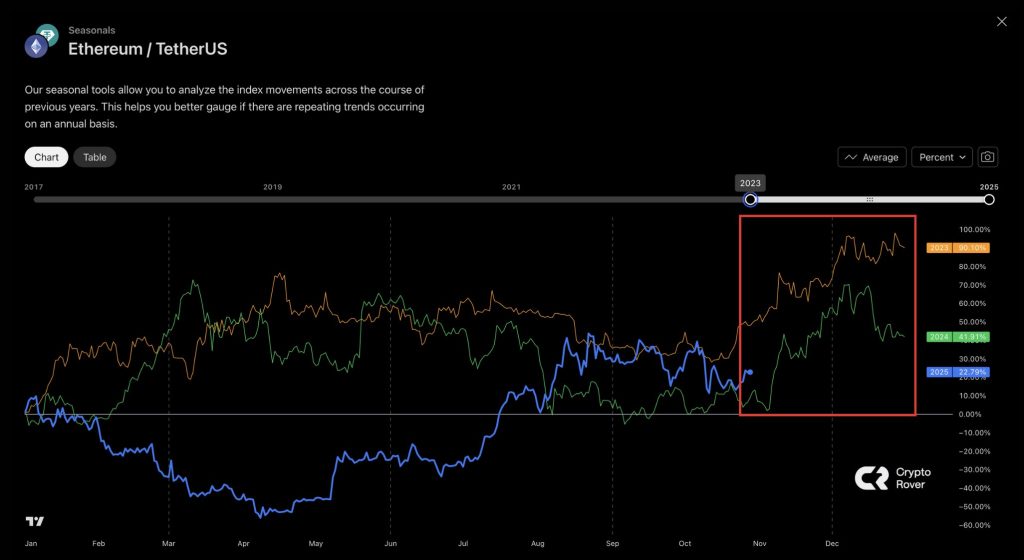

Crypto analyst Crypto Rover recently shared seasonal data suggesting this Q4 could be Ethereum’s “quarter of truth.” The analysis reveals a striking pattern: while ETH delivered powerful late-year rallies in 2023 and 2024, this year’s momentum is noticeably muted, raising doubts about whether the asset can replicate its traditional seasonal strength.

The chart tracking Ethereum’s seasonal performance tells a clear story. In 2023, ETH surged nearly 90% during Q4—one of its strongest finishes on record. The following year saw a solid 41.9% gain, maintaining bullish momentum despite a slower pace. Fast forward to 2025, and the picture looks different: ETH is up roughly 22.8%, marking a significant slowdown compared to previous cycles.

This divergence isn’t just about percentages—it reflects changing market dynamics. Several headwinds appear to be dampening Ethereum’s usual Q4 strength:

- Capital is flowing toward Bitcoin, especially with renewed institutional interest and ETF inflows pulling liquidity away from altcoins

- Ethereum lacks immediate catalysts this year—major upgrades like sharding remain in development, leaving fewer headline-grabbing moments to drive momentum

- Macro conditions are tighter, with higher interest rates and cautious risk appetite suppressing speculative activity across crypto markets

What the Chart Actually Shows

Despite the weaker Q4 showing, the chart reveals something important: Ethereum’s uptrend remains structurally intact. While the growth curve is flatter, ETH continues holding above mid-year lows, suggesting underlying stability rather than collapse. Historically, Ethereum’s strongest gains hit between October and December, fueled by increased trading volume and profits rotating out of Bitcoin. If those seasonal patterns kick in late, ETH could still mount a rally and narrow the gap with 2024’s performance.

But if the current trajectory holds through late November, it would mark a clear break from Ethereum’s usual rhythm—potentially signaling a shift toward slower, steadier growth rather than explosive year-end surges.

Why This Matters Beyond ETH

Ethereum’s Q4 performance carries weight far beyond its own price action. As the backbone of DeFi, Layer-2 networks, and NFT infrastructure, ETH’s seasonal strength often sets the tone for the entire altcoin market. When Ethereum closes the year strong, liquidity and confidence typically flow into smaller assets. A flat or weak finish, however, signals defensive positioning—with capital favoring Bitcoin and stablecoins over speculative plays.

In other words, how Ethereum finishes 2025 could shape not just its own 2026 outlook, but the trajectory of the broader altcoin landscape heading into the new year.