Institutional Bitcoin Holdings Now Exceed Retail Supply in Market Shift

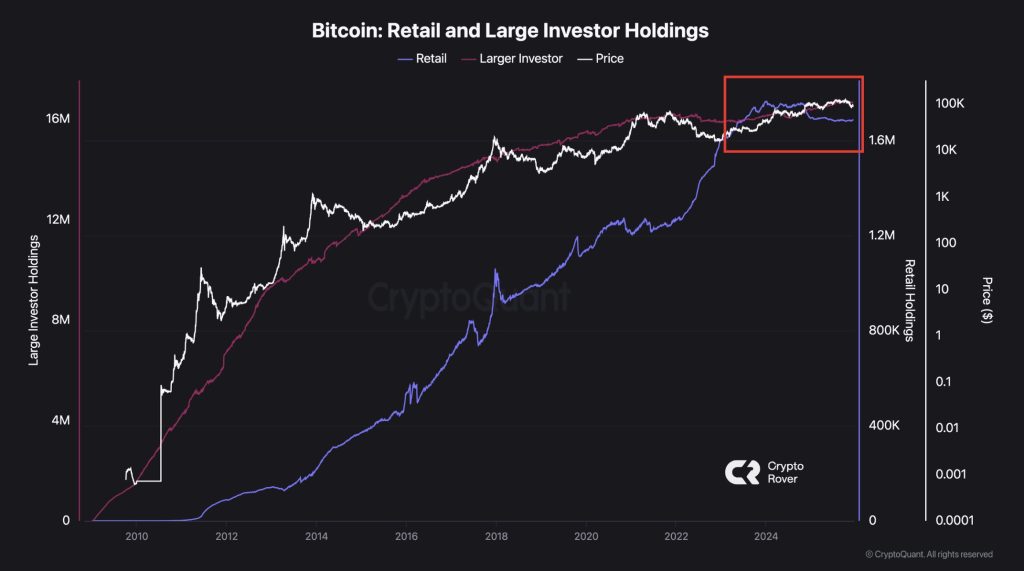

Bitcoin’s ownership landscape is going through a major transformation as institutional players have officially overtaken retail investors in total holdings. According to data shared by @CryptoRover, this crossover represents a significant turning point in how Bitcoin supply gets distributed across different market participants. The shift shows us that the nature of Bitcoin ownership is evolving beyond its retail-dominated roots.

Looking at historical patterns, retail holdings grew consistently from 2013 through 2021, moving in sync with Bitcoin’s major price rallies during those years. But something changed after the last cycle peak. Retail accumulation started slowing down noticeably, while institutional investors kept building their positions at a much steadier pace. The chart data reveals the exact moment when large investor balances crossed above retail holdings, even as Bitcoin’s price remained relatively high compared to its historical range.

What’s particularly interesting is how Bitcoin’s price movement seems to be disconnecting from retail accumulation patterns lately. As retail holdings have flattened out in recent months, institutional players are maintaining their elevated exposure levels. “The structural rebalancing in Bitcoin supply control suggests we’re entering a new phase where long-term institutional capital plays the dominant role,” according to the on-chain analysis.

This ownership transition carries real implications for Bitcoin’s future behavior. When institutions control a bigger chunk of the supply, Bitcoin might respond differently to macro events, liquidity shifts, and market stress compared to the retail-heavy cycles we’ve seen before. As the asset continues maturing, the institutional-retail balance will increasingly shape how Bitcoin moves and reacts across different market conditions.

My Take: The institutional takeover of Bitcoin holdings isn’t just a statistical curiosity—it fundamentally changes the game. We’re likely looking at more stable long-term holding patterns but potentially different volatility profiles during market stress.

Source: Crypto Rover